According to the official tweet on October 3, Ripple-powered payment mobile application “MoneyTap” is now officially available for download. The consumer-centric service was jointly developed by Ripple Lab and Japan-based banking giant SBI Holdings.

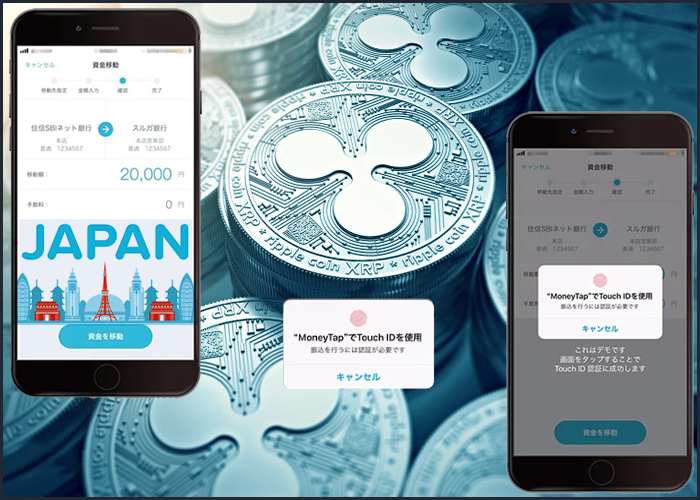

The product’s websites say that MoneyTap will utilize Ripple’s revolutionary product xCurrent to achieve domestic interbank transfers in real-time. Account holders at the three participating banks Resona Bank, Suruga bank, and SBI Sumishin Net Bank – can send and receive money via the mobile application, which runs on both Android and iOS devices.

Once users have registered, they will only be required to have a phone number or QR code to transfer funds in either local or international currencies, without paying a fee. Device’s inbuilt security technology will protect the payment system from criminals. Security features include biometric authentication system that utilizes fingerprint scanners.

As reported earlier by several news outlets, the biggest challenge that was preventing the launch of MoneyTap was defeated at the end of last month. The SBI Holdings announced that it had obtained a license from regulators to act as an electronic settlement service provider in the country.

According to past announcements, the service will attract a group of 61 banks in Japan – representing over 80% all baking assets in the country.

Bank transactions in Japan are usually carried out between 8:30 and 3:30. So, the app will offer users the opportunity to send and receive money in real time 24/7.

SBI is the second bank to launch an application that uses Ripple’s xCurrent to transfer funds. Earlier this, Spain-based banking giant Banco Santander launched OnePay FX, a mobile app that allows customers to settle cross-border payments faster and cheaply.

xCurent, however, does not use Ripple’s native token XRP like the recently launched xRapid solution. xRapid was launched to facilitate cross-border payments using XRP.