- Fed Governor Stephen Miran pushes for rapid rate cuts.

- Miran remains the sole dissenter at Fed meetings.

- Tensions with China’s influence discussed; immediate crypto impact unclear.

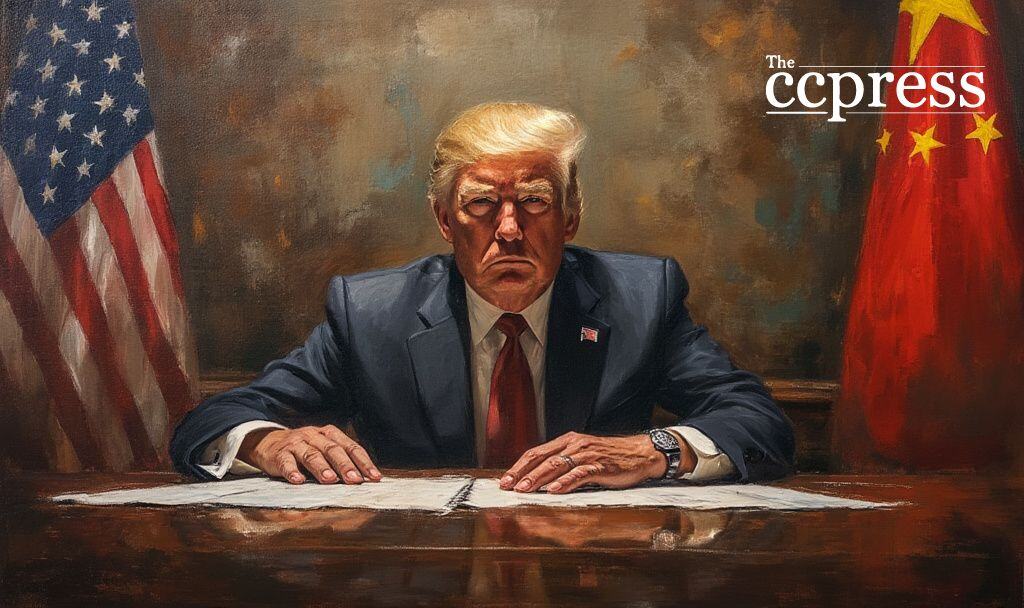

Federal Reserve Governor Stephen Miran has called for aggressive rate cuts amid rising U.S.-China trade tensions, positioning himself in contrast to current Fed policy.

Miran’s stance highlights divergences within the Federal Reserve that could impact economic forecasts, though immediate crypto market reactions remain speculative without data from primary sources.

Fed Governor Stephen Miran has publicly called for swift interest rate reductions, advocating for the federal funds rate to target the “mid-2% range.” His views come amid escalating U.S.-China trade tensions and inflation concerns.

Miran, a former chair of President Trump’s Council of Economic Advisers, was the only Fed member dissenting in favor of more significant rate cuts at recent meetings. “At the last meeting, I was the sole dissenter, advocating for a larger cut to address the current economic challenges.” – DTN Progressive Farmer. He suggests more aggressive actions compared to his colleagues.

The immediate effects of Miran’s calls are yet to manifest in policy changes. Markets focus on broader economic risks like inflation, but experts observe that Miran’s stance is notably more dovish. For more on this perspective, you can read the FOMC Minutes from September 17, 2025.

Analysts speculate on potential impacts on global markets and currencies, with Miran’s advocacy highlighting possible shifts in future monetary policy. His recent speech on September 22, 2025, emphasizes the scrutiny over the influence of trade tensions.

Historical trends often correlate Fed rate cuts with increased risk appetite, potentially affecting cryptocurrency markets. However, such effects depend largely on macroeconomic conditions.

Industry experts note that, despite historical data, no direct crypto market reaction could be tied to Miran’s comments. Fed policy shifts typically play a complex role in asset valuation dynamics, including cryptocurrencies. For further insights, check the Federal Reserve FOMC Projections for 2025.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |