- President Trump urges Powell for a Fed rate cut.

- Market prices in modest rate cut chances.

- Persistent inflation influences Federal Reserve decisions.

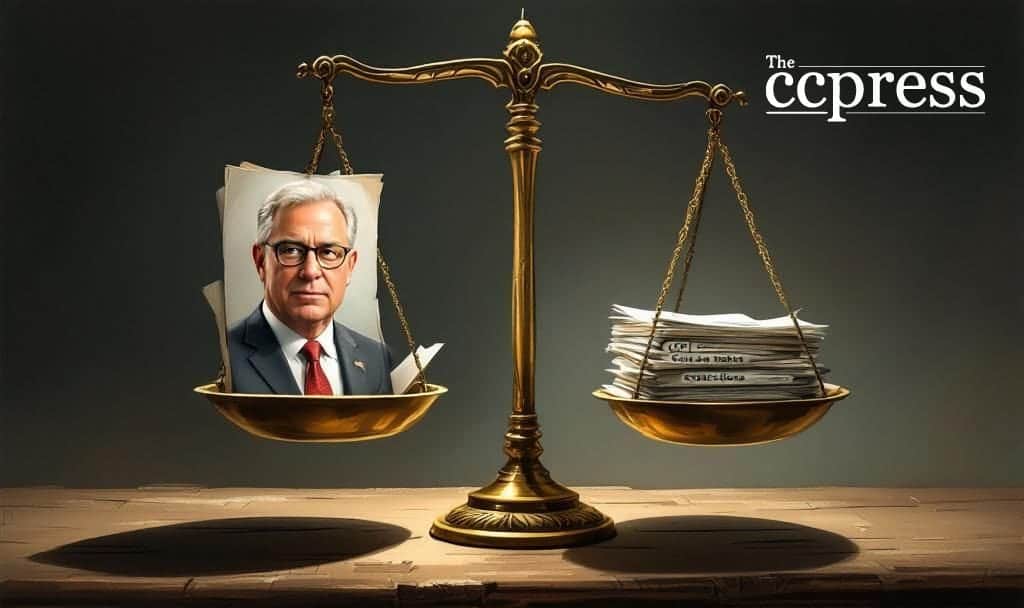

President Trump urges Federal Reserve Chair Jerome Powell to cut interest rates following a weaker-than-expected Consumer Price Index (CPI) inflation report released in December 2025.

Potential Fed policy shifts could affect economic conditions, though cryptocurrencies remain unimpacted according to market data, with investors eyeing further developments in traditional financial sectors.

Following a soft CPI inflation report, President Donald Trump has called for Federal Reserve Chair Jerome Powell to lower interest rates. The inflation report indicated easing pressures, prompting a push for potential monetary policy adjustments.

Trump, in urging for a rate cut, highlights the delicate balance Powell faces in maintaining economic growth. The FOMC, led by Powell, had already predicted interest rate changes amid evolving economic signals.

The demand for a rate cut reflects on market dynamics where the probability of a significant rate cut in January 2026 remains low. Investors are adjusting expectations around potentially shifting monetary policies.

Financial implications include projected Fed rate adjustments influencing broad economic conditions. The Congressional Budget Office anticipates Fed rates stabilizing in line with future economic forecasting models, factoring in growth and inflation trends.

“Trump’s call for a rate cut underscores the ongoing pressures on the Federal Reserve to support economic growth amidst fluctuating inflation trends.”

Market participants have priced in limited chances of immediate rate cuts, despite economic indicators suggesting scope for policy shifts. Economic resilience and inflation measurement continue to steer Fed actions.

Historical rate decisions this year have seen consistent adjustments based on inflation trends. The continuation of such policies will likely depend on further economic data. Markets remain cautious amid potential for further easing if conditions justify.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |