- Fed rate cut affects crypto market, DeFi, ENA ecosystem.

- Arthur Hayes sees $BTC reaching $100k, $ETH $3k.

- Reduction in crypto holdings indicates potential liquidity risks.

Arthur Hayes, BitMEX co-founder, highlighted potential significant shifts for crypto markets after the Federal Reserve’s 50 basis points rate cut, affecting assets globally.

This move is crucial as it signals potential market volatility and shifts in investment strategies, impacting Bitcoin, Ethereum, and other digital assets.

The Federal Reserve’s rate cut has initiated a potential reshape in the cryptocurrency market, with significant implications for major cryptocurrencies and altcoins alike.

Market Adjustments and Predictions

The Federal Reserve’s 50 basis points rate cut has sparked significant shifts in the cryptocurrency market. Arthur Hayes projects adjustments across crypto sectors, affecting DeFi and the Ethena (ENA) ecosystem.

Hayes, co-founder of BitMEX and currently CIO at Maelstrom Fund, anticipates notable market corrections. His strategic decisions, including selling large amounts of ETH, ENA, and other altcoins, highlight cautionary responses to changing liquidity environments.

Hayes’ actions signify reduced confidence in short-term resilience for altcoins like ENA. Market dynamics are impacted as institutional investors and industry leaders adjust their strategies in response to fiscal policy changes.

Financial implications are evident, with potential liquidity flowing towards traditional assets like government bonds. Hayes emphasizes stablecoin adoption aligning with larger economic liquidity trends, diverting direct funding from crypto to traditional finance.

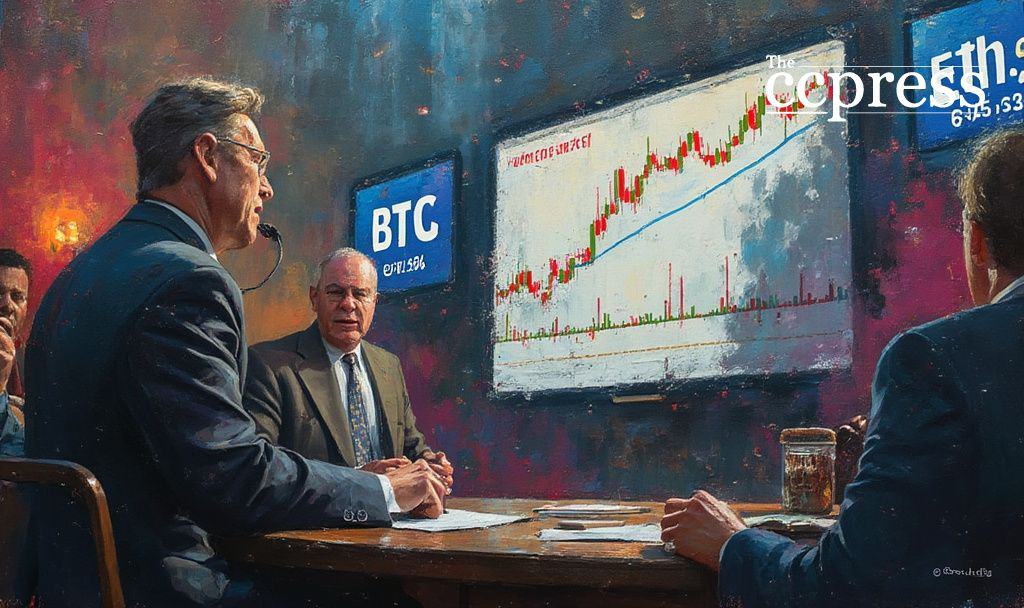

Analysts expect volatility in Bitcoin (BTC), Ethereum (ETH), and related cryptocurrencies. Hayes’ predictions include BTC testing $100k, while ETH may see $3k.

If macroeconomic trends shift, including liquidity stimuli, an upward trajectory is anticipated by 2025. Historical data suggests parallels to previous cycles, highlighting potential sharp retracements in the interim as market liquidity rebounds.

“No major econ is creating enough credit fast enough to boost nominal GDP. So $BTC tests $100k, $ETH tests $3k. Come see my @WebX_Asia Tokyo keynote Aug 25 for more info. Back to the beach.” — Arthur Hayes, CIO, Maelstrom Fund source

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |