Key Points:

- Bitcoin Price Analysis shows BTC trapped in a fragile range-bound structure, capped by overhead supply between $93,000 and $120,000

- Loss-carrying supplies have moved to cyclical highs, which indicates increasing stress and time pressure on investors.

- The lack of persistence in spot demand coupled with futures and options positioning ensures that the regime remains non-directional and one of consolidation.

Market Structure Remains Fragile Under Heavy Overhead Supply

Bitcoin Price Analysis highlights that Bitcoin remains trapped in a compressed and gradually weakening trading range, following repeated rejection near the $93,000 level. Though it has not fallen so far, with all attempts to recover being short-lived, it demonstrates the strength of the overhead pressure of previously existing buyers.

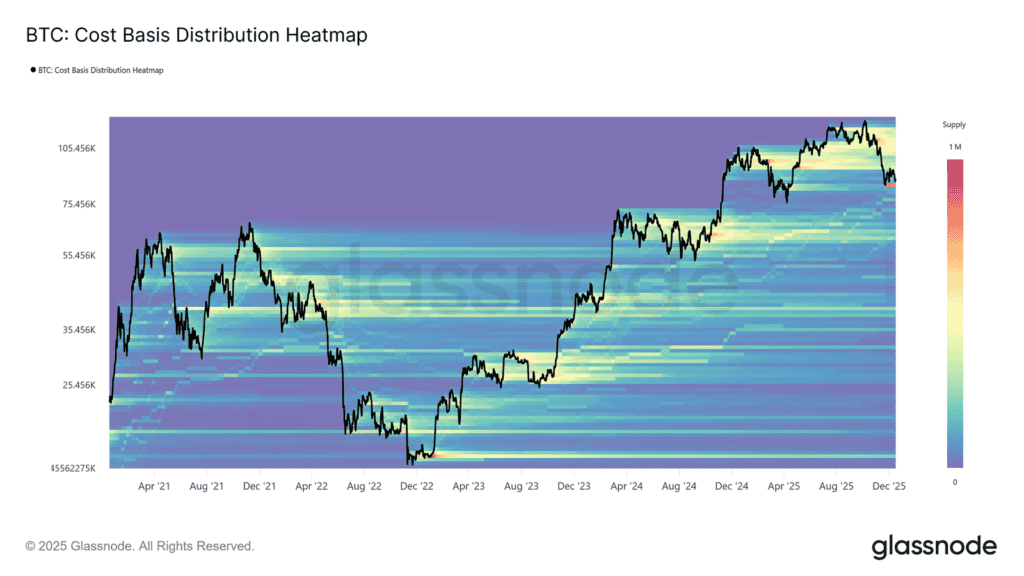

The on-chain cost-basis distribution indicates a tight grouping of coins accumulated between 93,000 and 120,000 dollars, which acts as a ceiling structure that limits the price movement. PRICE will continue to experience restricted recovery momentum as long as it remains below the 0.75 quantile at 95,000 dollars, without reclaiming the Short-Term Holder cost basis at 101,500 dollars.

Despite this pressure, the True Market Mean near $81,000 has so far been defended by patient demand, preventing a deeper breakdown. This leaves Bitcoin caught between persistent overhead resistance and structural support, reinforcing a time-contingent consolidation phase rather than a trend-driven move.

On-Chain Losses Build as Time-Driven Pressure Intensifies

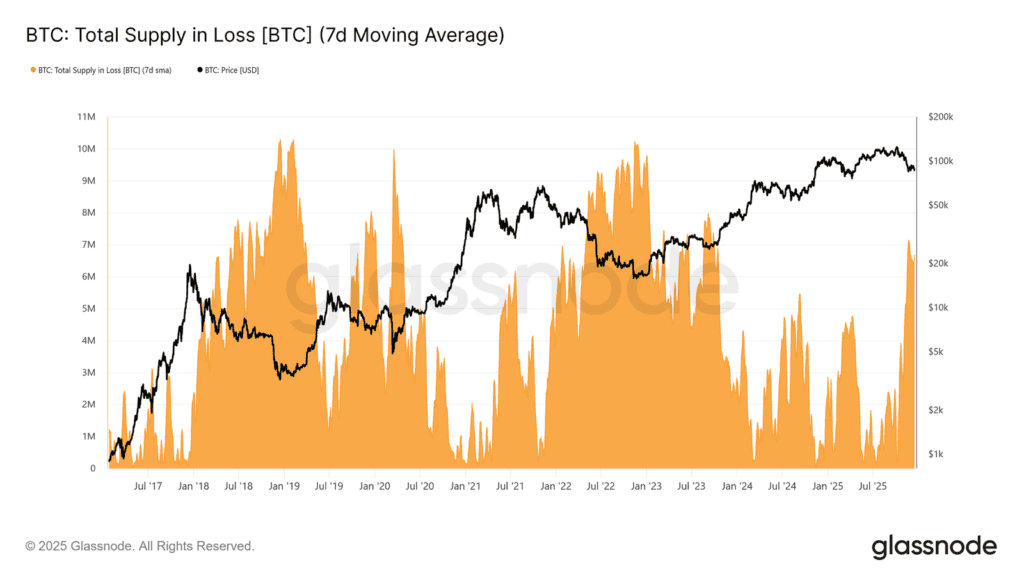

Looking deeper, on-chain analytics show that market stress continues to increase. The amount of Bitcoin that’s being held at a loss has now grown to about 6.7 million, which represents the highest amount within the current market cycle. Approximately 23.7% of the market’s supply now falls within this category.

While price is still bounded by the range, time has become the factor that exerts the strongest pressure. The loss-carrying supply that has been losing value has developed enough, and there is a possibility that less strong hands will start to melt away through time rather than leaving markets through violent liquidation events.

This is attested by behavior-driven indicators, as the Loss Seller group is consistently rising in number. Any definitive breach beneath the $81,000 level may accelerate this trend, thereby pressuring a weak market structure from both sell and buy sides. Currently, however, a bearish magnitude is sustained by relentless buyers at key support levels.

Spot, Futures, and Options Signal a Range-Bound Regime

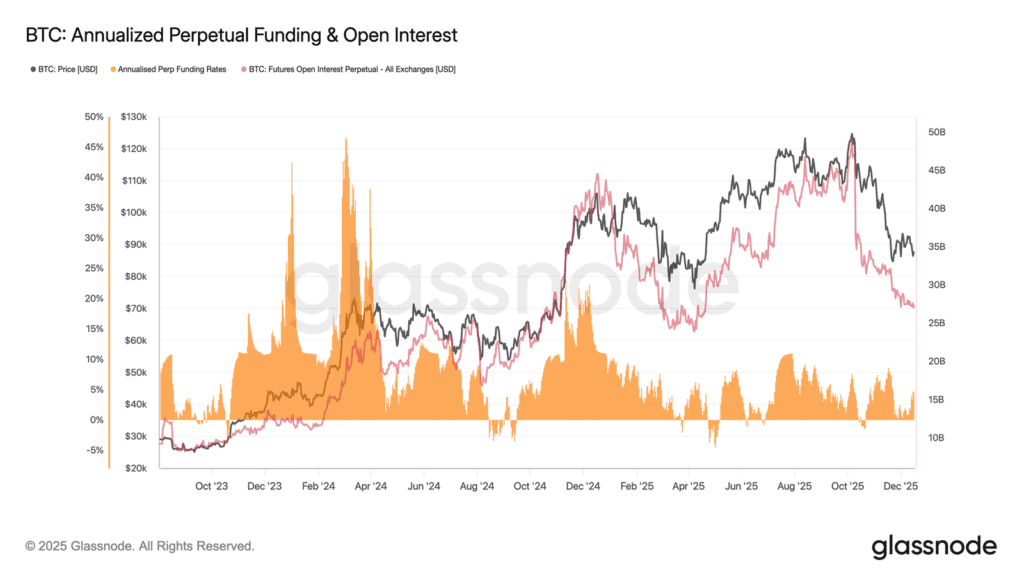

Off-chain market positioning continues to support the view that Bitcoin is consolidating. Spot markets have seen erratic and tactical demand, with pockets of buying yet to translate into accumulation phases. Dip-buying continues to be tactical rather than a systematic approach, leading to prices being driven entirely by derivative markets.

Futures markets are further de-risking, with open interest declining and funding rates near neutral. It is therefore likely that leverage is not causing the bearish pressure anymore, though there is not enough appetite on the upside either.

The options market has further strengthened the view of a non-directional regime. Implied volatility has compressed on the very short dated options, but protection on the downside has continued to be priced but stable.

Positioning has favored harvesting over the directional trades, and the very large expiries in the second half of December have left dealers positioned in such a manner as to mechanically encourage range-bound pricing in the proximity of the year-end.

Overall, this Bitcoin Price Analysis suggests the market is being driven more by structure than catalysts. It would likely need a completion of the sell-off above $95,000 or another wave of liquidity that would be sufficient enough to absorb the supply above and reclaim significant levels through cost basics.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |