Key Points

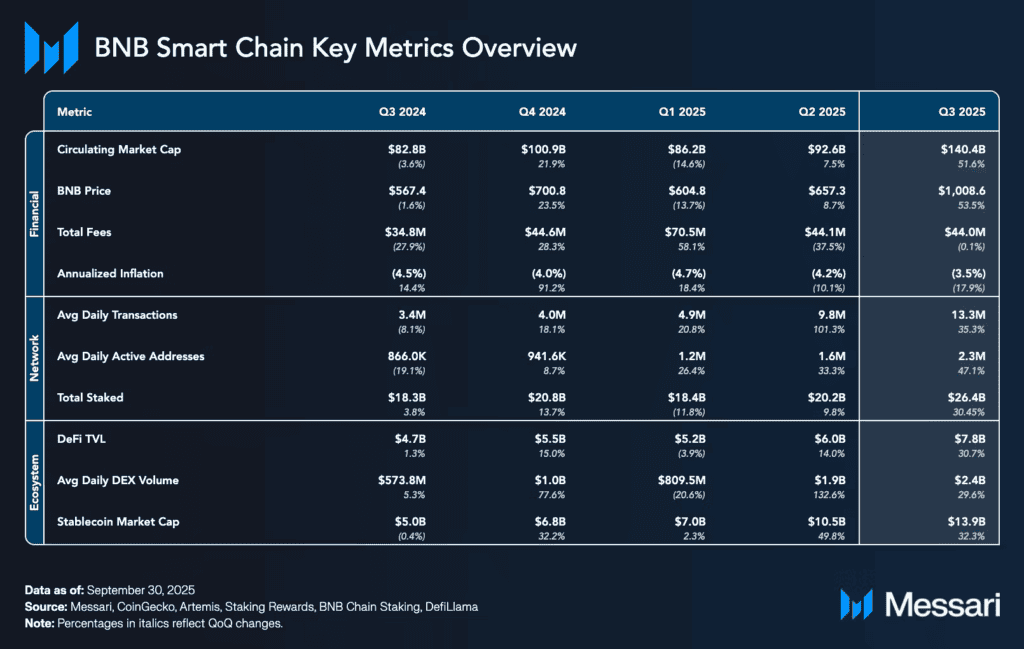

- The market capitalization of BNB appreciated by 51.6% QoQ to $140.4 billion and ranked it the fifth-largest crypto asset.

- On-chain activity reached a record high of 13.3 million daily transactions and 2.3 million daily active addresses.

- DeFi TVL increased by 30.7% QoQ to $7.8BN with the largest contributors being PancakeSwap

- Average DEX volume climbed 29.6% to $2.4 billion per day, placing BNB Chain second overall

- Infra upgrades like the Reth client and the Builder API improved the network speed by reducing MEV

The year 2025 saw BNB Chain begin Q3 with overall growth while enhancing its market valuation and usage. The market capitalization of BNB rose by 51.6% to $140.4 billion. As such, this resulted in an increase in the price of BNB to above $1,000 and surpassed Solana to rank fourth after Bitcoin, Ethereum, USDT, and XRP.

Meanwhile, network fees were relatively stable at $44 million with an increase in volume, and this was made possible due to the efficiency implications of the Lorentz and Maxwell upgrades, which optimized base gas prices and thereby cost per transaction.

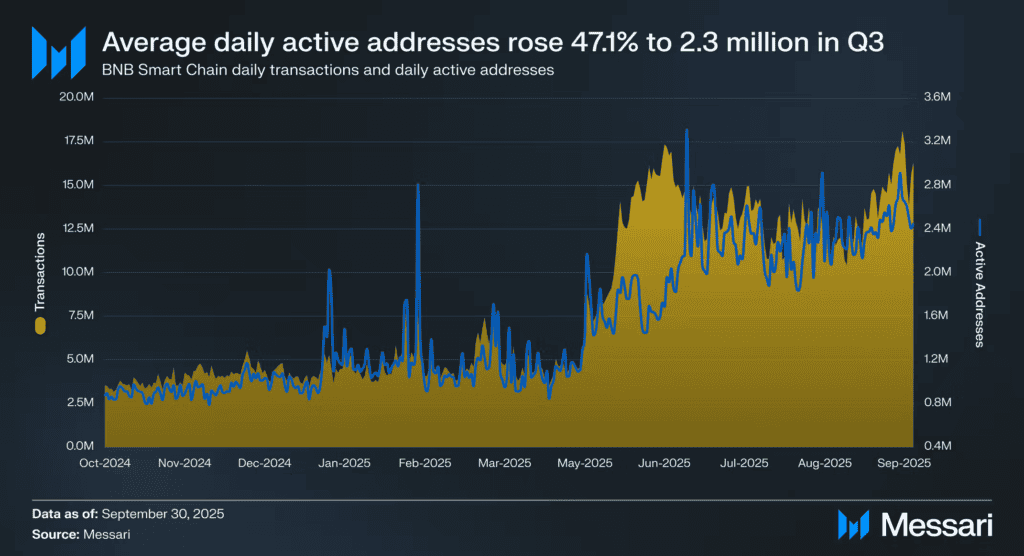

Users return as on-chain activity rises sharply

BNB Chain saw considerable growth in on-chain metrics in Q3 2025, with both user engagement and transacting capacity mounting. The blockchain processed an average of 13.3 million daily transactions. This marked a 35.3% increase QoQ. Active user wallets also surged to 2.3 million. This marked a 47.1% QoQ increase.

Such acceleration was catalyzed by developments in DeFi, stablecoins, NFTs, BTCFi, as well as on-chain gaming and trading, which have exhibited true usage-driven demand rather than speculation.

MEV reduction and speed improvements mark an infrastructure turning point

During the quarter, the infrastructural development and improvement of performance as well as safeguarding the users against adverse MEV behavior were the major focuses for the BNB Chain. It launched the alpha version of the Reth client with the capability for node synchronization that is 40% faster compared to Geth.

There was 99.8% adoption of Builder API, and this standardized the construction of blocks and improved tooling for MEV mitigation. This directly led to more than 95% reduction in sandwich attacks. There was continued coordination of validators, builders, and infrastructure partners through the Good Will Alliance to cleanse malicious MEV, and quicker block times to shorten the time window for attackers to operate.

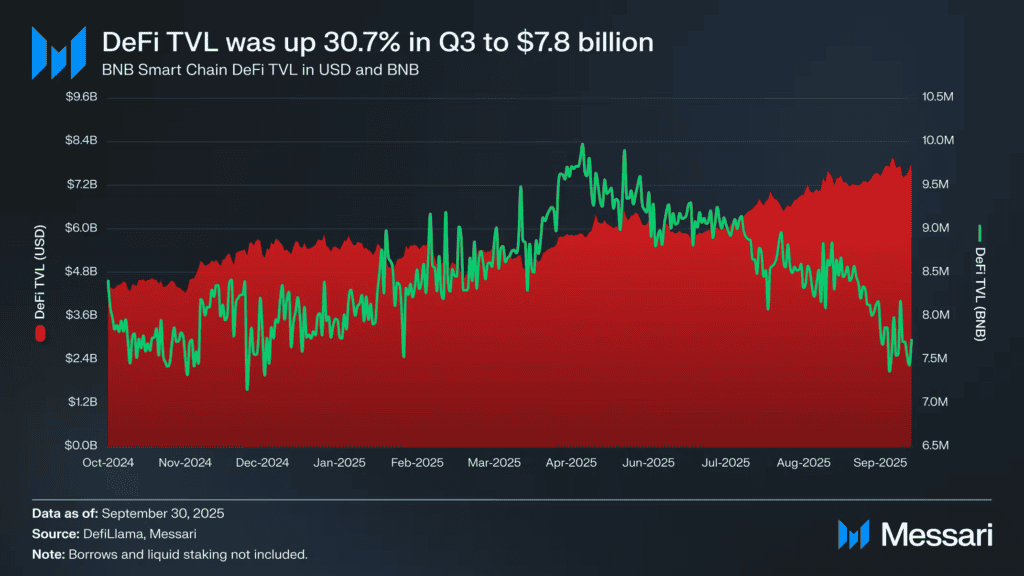

DeFi rebounds as Aster, ListaDAO, and PancakeSwap take the lead

The DeFi sector of BNB Chain saw a remarkable recovery in Q3 of 2025 with its total value locked (TVL) rising significantly by 30.7% to $7.8 billion. This solidified its position among the first three blockchains in terms of TVL. The leading protocols in terms of TVL continued to be PancakeSwap with $2.3 billion, ListaDAO with $1.9 billion, and Venus with $1.9 billion.

The standout performer was Aster, whose TVL surged 2,600% following its token generation event (TGE). The protocol distributed 704 million tokens via airdrop, expanded perpetual trading markets, and activated the USDF stablecoin, triggering significant new capital inflows into the BNB Chain DeFi ecosystem.

Stablecoins surge as USDe and USDF become key growth engines

The value of USDe rose above 1,025% QoQ, considering that Ethena added BNB as a collateral option and Binance added USDe support in all Spot, Derivatives, and Earn products. The value of USDF grew by 464%, boosted by an increase in demand in the Aster ecosystem, specifically in perpetual markets and on-chain collaterals. These trends show that the stablecoins are undergoing a transformation from a settlement tool to a liquidity pillar.

NFTs and gaming rebound alongside Binance ecosystem events

Binance Smart Chain sees significant resurgence in NFT activities as there was a 95% increase in BNB Chain trade volumes along with a 109.8% rise in NFT transaction numbers QoQ. Both utility and entertainment-based growth happened.

NFTs were employed as event passes for Binance Blockchain Week on platforms like Moongate, and games on opBNB and Binance Alpha-related projects drew even more users. Such a shift is indicative of NFTs maturing from mere collectibles to utility tokens.

Conclusion

The BNB Chain is coming out from the protective context that prevailed during the bear market and entering a new phase of expansion. The level of user engagement is increasing, there is substantial improvement in the infrastructure, DeFi is on the mend, and stablecoins and NFTs are growing.

If current trends continue, BNB Chain is on track to become a major hub for stablecoins and RWAs while staying among the top DEX ecosystems. It is also likely to expand BTCFi and liquid staking further. These trends point toward sustainable, utility-driven growth rather than short-term speculation.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |