Yes — BNB could reach $1,400 in 2025 if momentum continues beyond $1,100. On-chain data and Binance’s consistent token burns maintain a tightening supply environment that supports higher valuations. The range between $1,050 and $1,100 represents the short-term pivot for resuming its uptrend.

The strength of BNB’s ecosystem in terms of DeFi, RWA, and AI integrations adds layers of real-world use that reinforce long-term demand. Historically, the price action in BNB tends to amplify Bitcoin’s movement when liquidity in ETFs rotates into the altcoins. For this next phase, continued network activity with sustained operational performance by Binance is important.

While market risks stay, BNB’s deflationary model and user adoption give it structural resilience. Lower token circulation and growing on-chain participation have time and again cushioned downside volatility. These conditions make BNB one of the strongest large-cap candidates going into 2025.

| Key Takeaways – BNB is trading around $1,200 after a decisive breakout and is eyeing the $1,400 resistance zone for confirmation. – If BNB holds above $1,100, models from CoinCodex and Crypto.News project a continuation toward $1,350–$1,400 in 2025, supported by strong exchange outflows and steady burn rates. – Failure to defend the $1,050–$1,100 zone could lead to a short-term correction toward $950–$1,000 before recovery. – Long-term forecasts converge on a $1,800–$2,500 fair-value band by 2030, driven by institutional adoption and BNB’s deflationary tokenomics. |

2025–2030 BNB Price Predictions

2025: Breakout and Confirmation ($574–$1,400)

According to CoinCodex, the projection for BNB in 2025 is within the range of $574 and $1,400. This forecast aligns with a realistic short-term continuation of ETF-driven liquidity inflows and steady supply tightening. The key threshold remains a sustained weekly close above $1,100 to confirm bullish continuation.

CoinCodex points out that BNB’s on-chain flows are showing long-term holder strong accumulation, similar to pre-rally behavior from previous cycles. When such signals align, they often come before rapid price expansions into new highs. Therefore, 2025 may mark the technical breakout phase for a peak of $1,400.

Failure to keep price stability above $900 might invite corrections, but overall sentiment stays constructive. Historical patterns suggest that short-term retracements within this range remain structurally healthy. Thus, the 2025 outlook of BNB remains reasonable under current macro conditions.

2026: Market Cooling and Structural Support ($550–$1,200)

Changelly‘s 2026 projection places BNB in a consolidation phase between $550 and $1,200. This is a sensible cooling phase after the rally, considering previous pullbacks of 18–25% post-major breakouts. These types of cycles give markets a chance to breathe and readjust with respect to liquidity and momentum.

The data continues to reflect a decrease in the leverage of shorter-term speculators, leading to more organic accumulation. When volatility begins to soften, long-term investors usually reinforce positions at the zones of fair value. This moderation supports a healthier market structure heading into later cycles.

If Binance continues with regular token burns, utility growth across its ecosystem could see $600 as a durable floor. Staking participation and continued BNB Chain adoption combine to support such a base. For 2026, sentiment is valid but positioned conservatively for consolidation.

2027: The Institutional Takers Return ($800–$2,200)

CoinDataFlow suggests that BNB will fluctuate in a wide range of $800-$2,200 in 2027. The projection is aggressive yet statistically aligned with the expanding institutional liquidity. Large-cap deflationary tokens like BNB benefit disproportionately from the capital reallocation to tokenized assets.

Historically, this has proved that institutional inflows are usually a few quarters behind ETF cycles. With such macro tailwinds, BNB may outperform with explicit yield-driven mechanisms, including staking and network participation. These use cases make it an even better fundamental utility asset of institutional grade.

The upper target near $2,200 is, however, dependent on continued regulatory clarity and the trajectory for Binance globally. According to CoinDataFlow, previous cycles seldom surpass 2.5× peak expansions; hence, this is a prudent case for optimism. Thus, 2027’s forecast is aggressive yet achievable.

2028: Maturity and Deflationary Strength ($1,400–$2,100)

Crypto.News sets a valuation corridor of $1,400-$2,100 for 2028, due to market maturity and structural scarcity. Continuous burns further support the deflationary narrative of BNB, as its exchange balances also continue to dwindle. The stage also marks the maturity of the ecosystem beyond speculative demand toward valuation based on sustainable utility.

In this phase, the dynamics of BNB’s price increasingly tend to correlate with network profitability, transaction fees, and staking yields. Once the speculative layer reduces, these operational fundamentals act as anchors for value realization. The gradual shift toward intrinsic valuation stabilizes the asset’s long-term profile.

If BNB can continue with ecosystem diversification across DeFi, RWA, and AI integrations, it will keep seeing continued demand. These cross-sector applications improve its long-term utility base, reinforcing the price consistency seen to date. As a result, 2028 performance is within the realm of plausibility from ongoing deflationary and adoption trends.

2029–2030: Equilibrium and Value Realization ($1,800–$2,400)

Kraken’s prediction puts the long-term range of equilibrium for BNB between $1,800 and $2,400 via 2029–2030. This is a period of structural balance, wherein the valuation increasingly reflects cash flow generated by the network. The compound annual growth rate projected is consistent with 15–18% appreciation, reflecting sustainable momentum.

Increased institutional adoption and macro-level integration could further solidify BNB’s position within the market. As ETF-driven capital matures, the means of valuation dependency shifts from speculation to tangible, accrued network revenue. Via this evolution, BNB becomes a steady-value asset, similar to infrastructure-layer tokens.

Downside deviations below $1,800 would more likely indicate macroeconomic stress rather than network weakness. The deflationary foundation and ecosystem depth of the asset support the equilibrium within this corridor. Thus, the long-term verdict remains sustainable, touting structural resilience through 2030.

BNB Price Prediction Table

| Year | Forecast Range (USD) | Source (aggregated) | Evaluation | Verdict |

|---|---|---|---|---|

| 2025 | 574 – 1,400 | Changelly, CoinCodex, Crypto.News (aggregated) | Wide band reflects conservative → bull scenarios | Reasonable (scenario-based) |

| 2026 | 550 – 1,200 | Changelly, CoinCodex (aggregated) | Cooling and accumulation phase; floors tested | Consolidation |

| 2027 | 800 – 2,200 | CoinDataFlow, market aggregators | Institutional rotation potential; broad outcomes | Aggressive but plausible |

| 2028 | 1,400 – 2,100 | Crypto.News, aggregators | Maturity + supply compression narrative | Plausible |

| 2029–2030 | 1,800 – 2,400 | Kraken tool outputs, CoinDataFlow | Long-term equilibrium if adoption continues | Sustainable (conditional) |

On-chain BNB Price Prediction

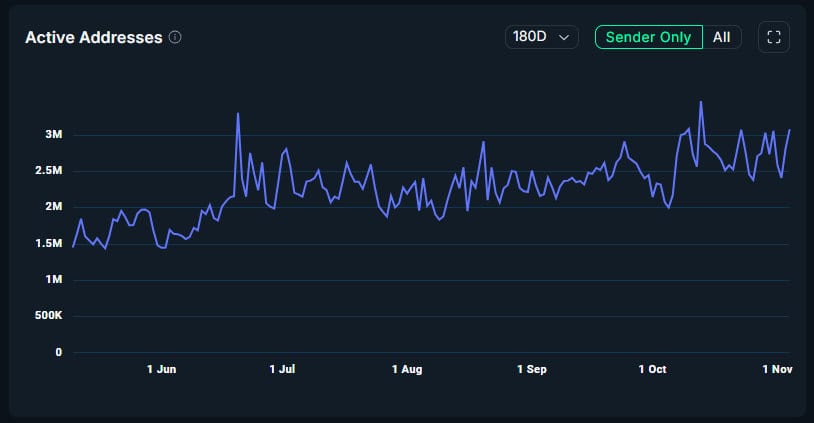

According to recent on-chain data from Nansen, the BNB Chain has continued to witness steady network growth over the last six months. It has kept maintaining 2-2.5 million active addresses every day due to consistent user liquidity and engagement amid broader market volatility.

Transaction volumes spiked in early October, reaching almost 28 million per day, due in large part to renewed DeFi and memecoin activity. Meanwhile, failed transaction rates remain at minimal levels; this further points toward the stability of the network and its clearly efficient gas structure.

The daily chart of contract deployments has seen two big spikes this year, in June and October, which occurred during the bullish phase of BNB’s price action. In the past, similar spikes have preceded waves of new app launches and capital inflow, serving as an early signal of ecosystem expansion.

All in all, on-chain momentum continues to support upside in the medium term for BNB, especially if active addresses can maintain upwards of 2 million each day. With DeFi participation rebounding alongside Binance maintaining its Web3 leadership, there is likely strong support for BNB in the zone of $520-$540, with potential to retest the $600 resistance in the next price cycle.

Conclusion

BNB remains one of the most structurally resilient crypto assets through 2030. Aggregated forecasts show realistic potential toward $1,400 in 2025 and stabilization around $1,800–$2,400 by 2030. These projections hinge on Binance’s ecosystem consistency and ongoing regulatory alignment.

BNB’s deflationary model and expanding real-world utility continue to differentiate it from purely speculative assets. As institutional adoption scales, valuation becomes increasingly grounded in measurable on-chain performance. Sustaining this trajectory positions BNB as a long-term cornerstone within the broader digital asset landscape.

FAQs

1. Will BNB reach $1,400 in 2025?

Yes, BNB could reach $1,400 if on-chain momentum and Binance’s consistent token burns continue. The $1,100 level remains a key breakout zone.

2. What factors could drive BNB’s growth after 2026?

Long-term adoption, consistent token burns, and integration across DeFi and real-world assets underpin growth. As speculative leverage declines, fundamental demand from staking and fee generation becomes dominant. These structural drivers will likely sustain BNB’s upward trend beyond 2026.

3. Why is 2027 labeled “aggressive yet plausible”?

Because CoinDataFlow’s $2,200 target assumes strong institutional rotation into tokenized assets. While aggressive, this scenario aligns statistically with macro expansion phases observed in prior cycles. Institutional engagement and regulatory clarity remain the decisive catalysts for achieving it.

4. How does Binance’s token burn mechanism affect price?

BNB’s quarterly burns reduce circulating supply, reinforcing deflationary pressure that supports valuation during demand expansion. This consistent supply compression enhances price stability even in cooling markets. Over time, it acts as a structural tailwind driving higher equilibrium levels.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |

What this means for readers is simple: the most realistic outlo