- Bo Hines steps down, changing White House crypto leadership.

- Trump’s crypto policy direction influenced by Hines’ departure.

- No immediate market disruption reported post-resignation.

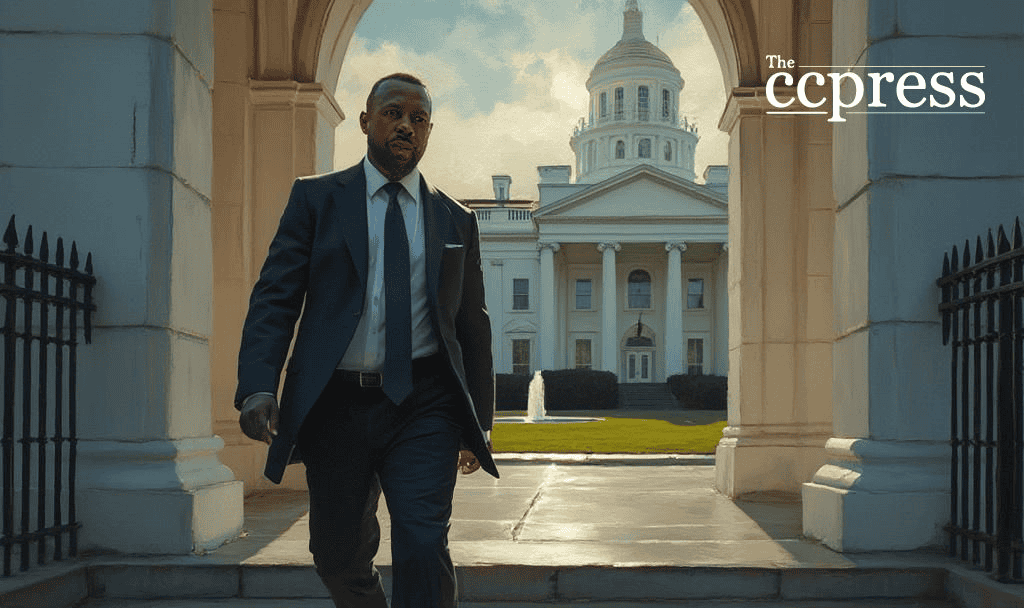

Bo Hines, key architect of the Trump administration’s crypto policy, announced his resignation as Executive Director of the President’s Council of Advisers on Digital Assets on August 9, 2025, to rejoin the private sector.

Hines’ departure underscores the administration’s continuity in pro-crypto policy, with his deputy expected to maintain strategic initiatives like the GENIUS Act, ensuring regulatory stability amid leadership changes.

Bo Hines, White House digital assets adviser, has announced his resignation. This development marks a significant shift in the administration’s cryptocurrency advisory landscape. Hines played a pivotal role in shaping pro-crypto policies for the Trump administration.

Bo Hines served as the Executive Director of the President’s Council of Advisers on Digital Assets. He was instrumental in recent policy frameworks and the passage of the GENIUS Act, which established stablecoin regulations. Patrick Witt will succeed Hines, ensuring continuity.

Hines’ departure impacts the White House’s crypto strategy, though market reactions have been muted. His leadership helped establish frameworks that supported regulatory clarity for digital assets, particularly stablecoins, which remain unaffected immediately.

“Serving in President Trump’s administration and working alongside our brilliant AI & Crypto Czar @DavidSacks as Executive Director of the White House Crypto Council has been the honor of a lifetime.” Hines highlighted the financial implications of his exit, which include maintaining focus on initiatives like 401(k) crypto access. Regulatory clarity as seen in the GENIUS Act is crucial for future market stability. Meanwhile, Bitcoin trades above $117,000, reflecting strong market trends.

Although the leadership change is noteworthy, historical precedents suggest no lasting disruptions. Typically, shifts in U.S. digital asset policy lead to temporary uncertainty rather than persistent market issues.

Analysts predict minimal changes to the regulatory landscape, given that frameworks are already in place. The administration’s commitment to nurturing a pro-crypto environment remains strong, with ongoing support for digital asset integration and regulation.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |