- Susan Collins reassures Fed’s market stabilization readiness.

- Reassurance led Bitcoin to surge 5%.

- Fed might use non-traditional tools for market stability.

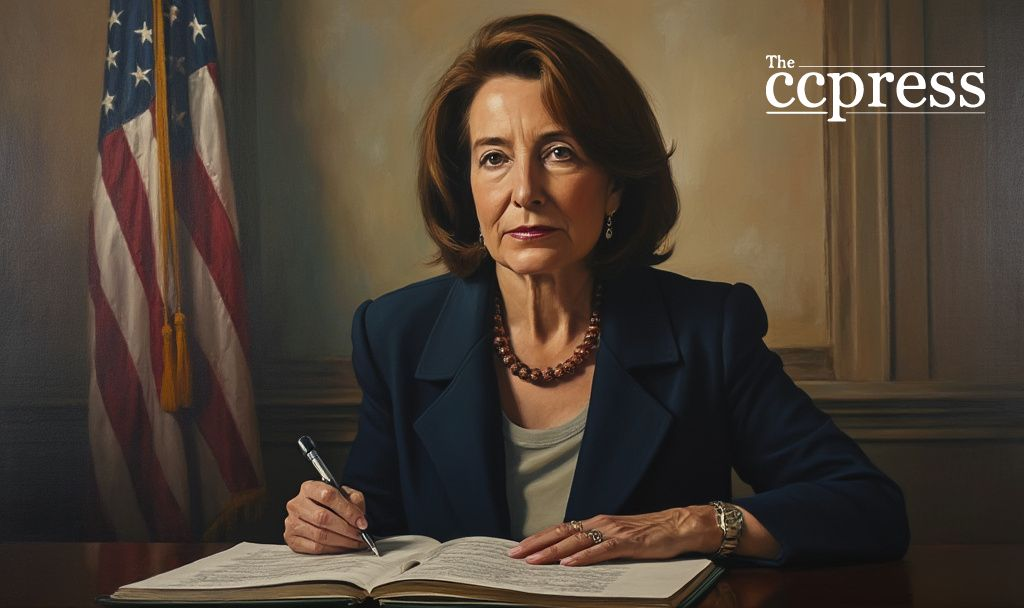

Susan Collins, President of the Federal Reserve Bank of Boston, recently reassured financial markets of the Fed’s preparedness to intervene using available tools. Her remarks come amid heightened market instability concerns.

Collins emphasized that the Fed would employ measures beyond traditional interest rate cuts. This approach indicates a proactive stance to ensure market functioning remains stable at all times.

The reassurance was met with a positive response from financial markets. Bitcoin’s price surged 5% on the news, trading near $84,000, reflecting investor confidence in response to Collins’ comments.

The Treasury markets saw increased volatility, with the 10-year yield rising to 4.5%. Such movements highlight the increasing concern over liquidity amidst broader market turbulence.

Expert opinions indicate that the Federal Reserve might rely on tools such as open market operations and quantitative easing. These alternatives have been historically used to stabilize yields and have positively impacted cryptocurrencies.

Financial history demonstrates that similar Fed interventions in the past have restored confidence in risky assets like Bitcoin, suggesting a potential for future recovery. “The central bank would absolutely be prepared to act if the situation turns chaotic… We do have tools to address concerns about market functioning or liquidity should they arise,” said Susan M. Collins, President, Federal Reserve Bank of Boston. Market stability is often viewed favorably, boosting decentralized asset confidence.