- Chris Giancarlo joins Sygnum Bank, boosting market confidence.

- No immediate impact on funding.

- Long-term potential for increased institutional engagement.

Giancarlo’s new role reflects a shift towards stronger regulatory mechanisms in the cryptocurrency sector and anticipates increased institutional comfort regarding digital banking services.

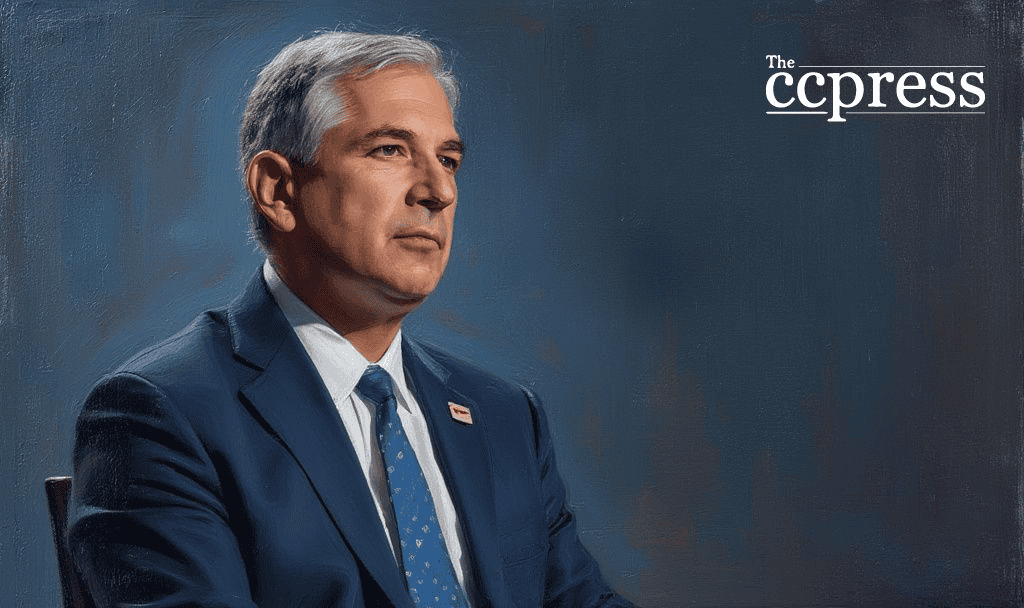

Sygnum Bank, a regulated digital asset bank, has appointed Chris Giancarlo, noted as “Crypto Dad,” for his pro-blockchain regulations stance. He served as CFTC Chair from 2014 to 2019.

The appointment is expected to positively influence long-term market sentiment for major cryptocurrencies like Bitcoin and Ethereum. It highlights the growing regulatory collaboration within the industry. “J. Christopher Giancarlo, Former US CFTC Chairman, joins Sygnum as Senior Policy Advisor.”[1]

While no immediate funding announcements were made, the relationship emphasizes a regulatory strategy over short-term capital injections. Sygnum continues to focus on developing its banking and custody services without concerns about on-chain liquidity changes.

Regulatory precedents indicate that Giancarlo’s presence could enhance institutional trust, similar to past instances where former regulators joined major crypto firms. Market optimism is cautiously high based on the historic institutional engagement successes.

The broader cryptocurrency community views this move favorably, awaiting potential advancements in legal clarity and market stability. Community sentiment remains positive, suggesting a future increase in institutional activity.

The immediate effect of this collaboration remains uncertain, but experts predict that in the long run, confidence in crypto banking and compliance will grow, encouraging more institutional investments and broader market acceptance.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |