- Conflict arises over cryptocurrency containment policies and market risk.

- Perkins calls BIS’s recommendations dangerous, potentially increasing risk.

- Market response to BIS report remains stable, minimal price impact.

The criticism of the BIS report by Christopher Perkins highlights ongoing tensions in cryptocurrency regulation, underscoring potential impacts on market dynamics. The industry watches carefully, but immediate market disruptions remain minimal.

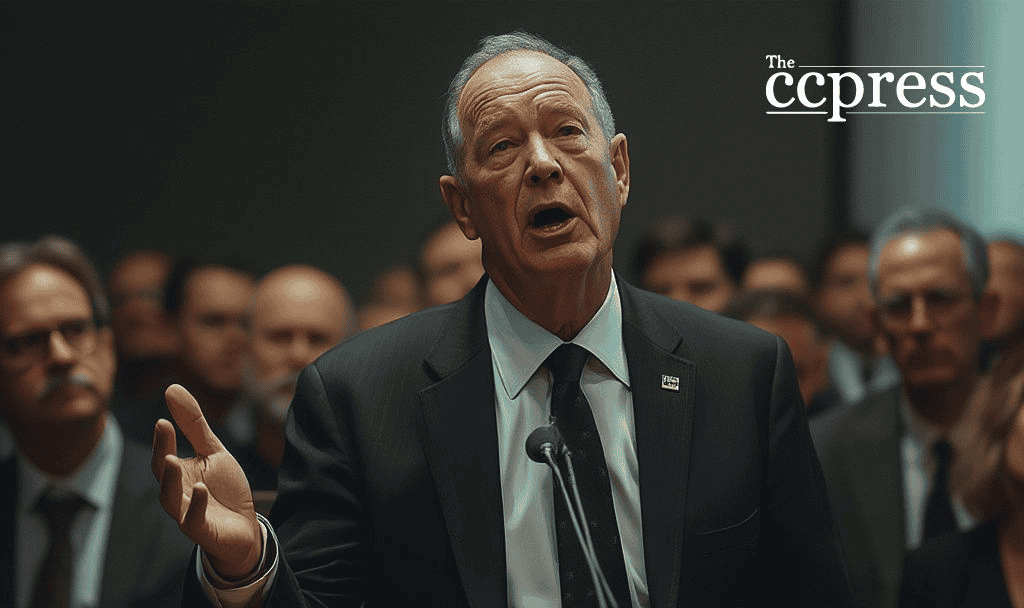

Christopher Perkins’ Critique

Christopher Perkins criticized the BIS April report, describing its content as misinformed and potentially dangerous. He argues that the recommendations present systemic risk rather than mitigation. The BIS report called for regulatory interventions, focusing on cryptocurrency containment.

Involved parties include Christopher Perkins and the BIS. Perkins contested the BIS’s stance on DeFi and stablecoins, promoting open-source transparency. As Perkins noted:

“Many of their recommendations and conclusions—perhaps due to a mix of fear, arrogance or ignorance—are completely uninformed and frankly, dangerous. If implemented they will cause—not mitigate—the systemic risk they seek to prevent.”

He emphasized that crypto systems are more accessible and transparent than current financial structures. Perkins warned that containment policies could insulate traditional financial systems from the benefits of real-time crypto markets. The implication is that these recommendations could pose greater liquidity risks for institutions rather than improving safety. Despite the strong words from Perkins, immediate market reactions remained muted. Bitcoin and Ethereum prices saw minimal impact, indicating market resilience to traditional regulatory criticisms.

Financial implications include increasing scrutiny on cryptocurrency regulation, possibly leading to enhanced oversight or modified policies. The BIS report reflects a recurring theme of cautious regulation, yet the market continues showing robust confidence. Research and analysis suggest continued debates on cryptocurrency regulation will likely persist. Historical trends show regulatory scrutiny often brings volatility, yet markets tend toward stability over time. Market participants expect further developments as regulatory bodies and industry leaders negotiate paths forward.