- The Ether Machine acquires 15,000 ETH for $57.1M.

- Aims to create the largest ETH portfolio.

- Potential market impact through strategic accumulations.

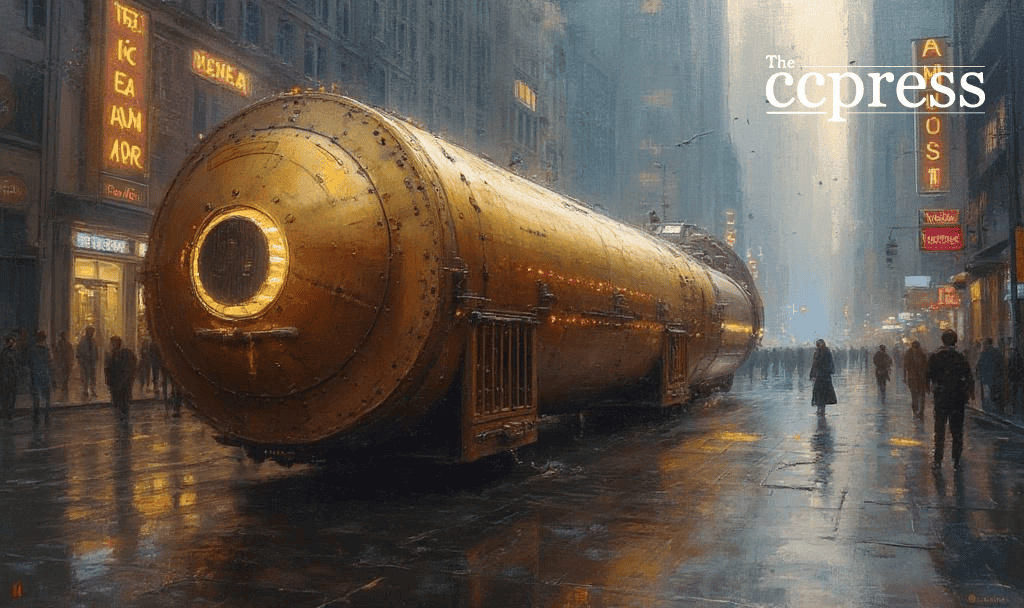

The Ether Machine has acquired 15,000 ETH, valued at $57.1 million, marking a strategic move shortly after its public launch to enhance its Ethereum-focused investment strategy.

The significant purchase reflects increasing institutional interest in ETH, potentially influencing market liquidity and sparking bullish trends amid Ethereum’s 10th anniversary celebrations.

The Ether Machine, a publicly traded company, purchased nearly 15,000 ETH worth $57.1 million as part of a larger strategy to build a significant ETH portfolio. This acquisition aligns with Ethereum’s 10th anniversary celebrations, marking a pivotal move.

Andrew Keys, Chairman and Co-Founder of The Ether Machine, emphasizes deepening their commitment to Ether, viewing it as the backbone of a new internet economy. The firm received substantial institutional backing, showcasing confidence from industry leaders.

The purchase is set to impact the Ethereum market by reducing its liquidity as The Ether Machine executes its treasury strategy. On-chain analysts suggest similar corporate accumulations have previously bolstered ETH prices.

The $97 million funding for this purchase derives from an earlier private placement, with additional plans to further absorb market liquidity anticipated. The moves resemble strategies previously undertaken by companies like SharpLink.

Historical data highlights such acquisitions often signal bullish market trends and positive price movements. The Ether Machine’s continued Ethereum investments may similarly influence future valuations.

“We couldn’t imagine a better way to commemorate Ethereum’s 10th birthday than by deepening our commitment to ether. We are just getting started. Our mandate is to accumulate, compound, and support ETH for the long term – not just as a financial asset, but as the backbone of a new internet economy.” — Andrew Keys, Chairman and Co-Founder, The Ether Machine

These corporate actions frequently correlate with increased staking rates and on-chain activity, pointing to Ethereum’s vital role within the broader DeFi sector. This current buy aligns with trends towards institutional Ethereum adoption.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |