- Federal Reserve’s Bowman addresses community banking regulations at summit.

- Focus on enhancing regulatory transparency and efficiency.

- No impact on cryptocurrencies or DeFi protocols mentioned.

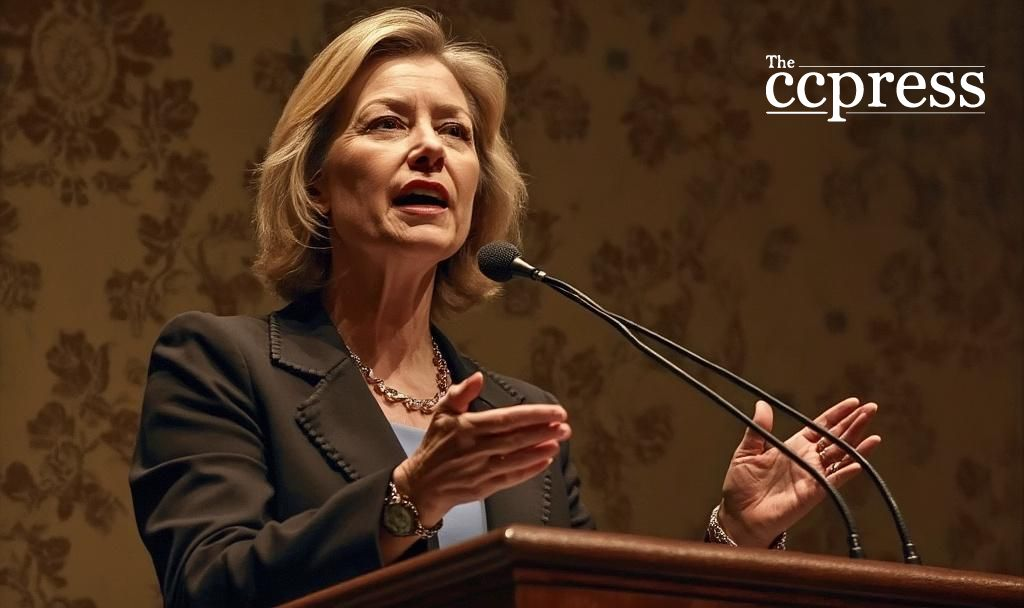

Federal Reserve Vice Chair for Supervision Michelle W. Bowman announced regulatory reforms focused on community banks at the Kansas Bankers Association 2025 Summit.

Bowman’s focus on regulatory reforms aims to enhance banking efficiency and transparency, with no immediate impact on cryptocurrency markets.

Federal Reserve Vice Chair for Supervision Michelle Bowman delivered a keynote at the Kansas Bankers Association. Her speech emphasized regulatory reforms and community bank capital, reinforcing the Fed’s commitment to improving efficiency and resilience in traditional banking.

Bowman’s keynote highlighted her sustained focus on engaging with community banks, emphasizing regulatory strategies. Her leadership aims at fostering transparency and fairness, though no specific mention of digital assets or cryptocurrencies was made. Michelle Bowman stated, “Since assuming this important financial regulatory role, we have hit the ground running—addressing some of the most critical matters in the bank regulatory space, all of which fall under the broad categories of improving efficiency, transparency, and fairness.”

The direct effects of Bowman’s address are primarily on community banks, reaffirming regulatory thresholds and enhancing supervisory processes. This approach aims to stabilize and support traditional U.S. banking infrastructure.

The implications of Bowman’s speech center on strategic financial reforms within the banking sector. By prioritizing transparency and efficiency, the address seeks to reinforce the resilience of community banking in the broader financial market.

Addressing economic outlook and regulatory strategies, Bowman avoids alluding to cryptocurrencies. Her focus remains on traditional banking improvements. The lack of crypto-related insight leaves digital asset markets largely unaffected by her recent statements.

Bowman’s focus points to potential regulatory outcomes bolstering traditional banking processes. Historical trends and prior speeches suggest continuous support for prudent lending, effective supervision, and regulatory clarity within the finance sector, omitting digital financial technologies.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |