- Fed cuts interest rate, impacting economic indicators like inflation and growth.

- Chair Jerome Powell emphasizes dual mandate challenges.

- Market may see increased liquidity affecting investments.

The Federal Reserve announced a 25 basis point interest rate cut to 4-4.25% at the recent FOMC meeting, responding to a weakening labor market and persistent inflation concerns.

The rate cut may influence investment and spending, with potential impacts on cryptocurrency market sentiment and liquidity amid existing economic uncertainties.

Fed Conducts Rate Cut Amid Economic Challenges

The Federal Reserve conducted its first rate cut of the year, lowering rates by 25 basis points. This change was influenced by a weakening labor market and elevated inflation. The new rate range is 4% to 4.25%.

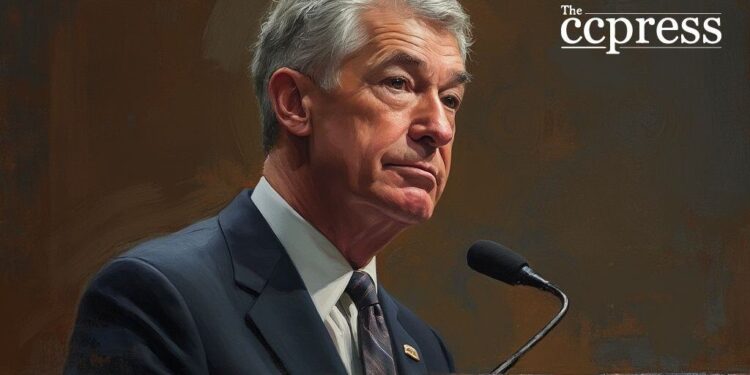

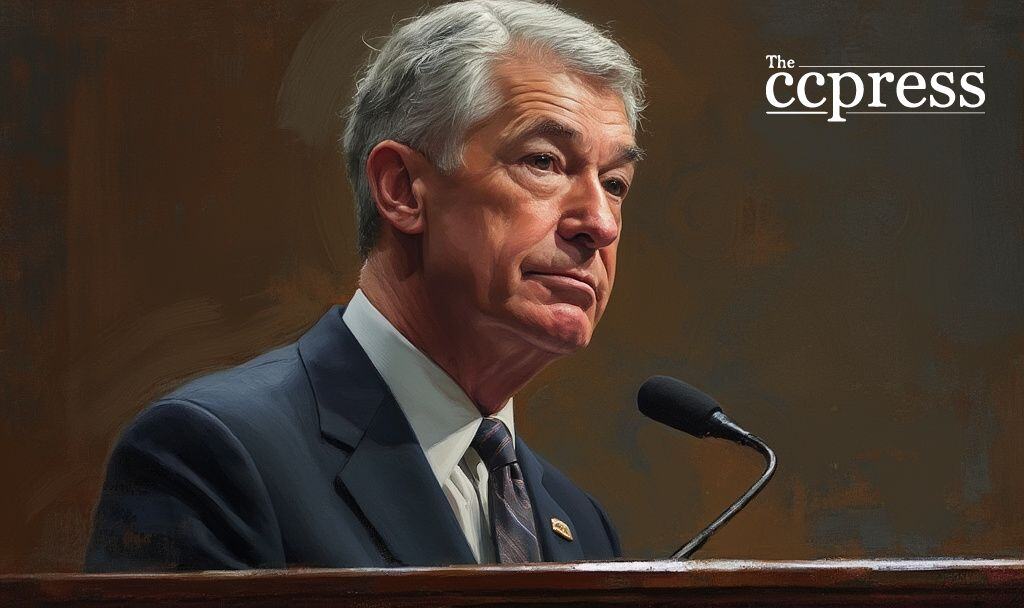

Jerome Powell, the Federal Reserve Chair, emphasized the Fed’s commitment to its dual mandate:

The Fed’s dual mandate includes maximizing employment while maintaining price stability, and we are constantly assessing the balance between these objectives given current economic conditions.

Stephen Miran also played a role, advocating a more aggressive cut. The decision reflects the economic challenges currently faced.

Potential Market Impacts and Future Outlook

The rate cut is expected to reduce borrowing costs, potentially increasing investment and consumer spending. Stock and cryptocurrency markets might also see changes in response to adjusted market dynamics.

While no direct on-chain impact is noted, market sentiment could shift, affecting investments in cryptocurrencies. Regulatory views on digital assets may indirectly be influenced by these monetary policies.

The decision may hint at further economic interventions if conditions do not improve. Market participants are closely monitoring Fed policies amidst ongoing economic uncertainties.

Historically, rate cuts have often led to investments in riskier assets like BTC and ETH. This move may trigger similar trends, although current conditions could influence outcomes differently. Analysis and data suggest potential increased liquidity and price shifts.

For more details, you can view the Federal Reserve FOMC Meeting Calendars.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |