- Mary Daly hints at possible rate cuts in 2025.

- Potential rate cuts reach beyond initial expectations.

- Crypto and equity markets stand to benefit.

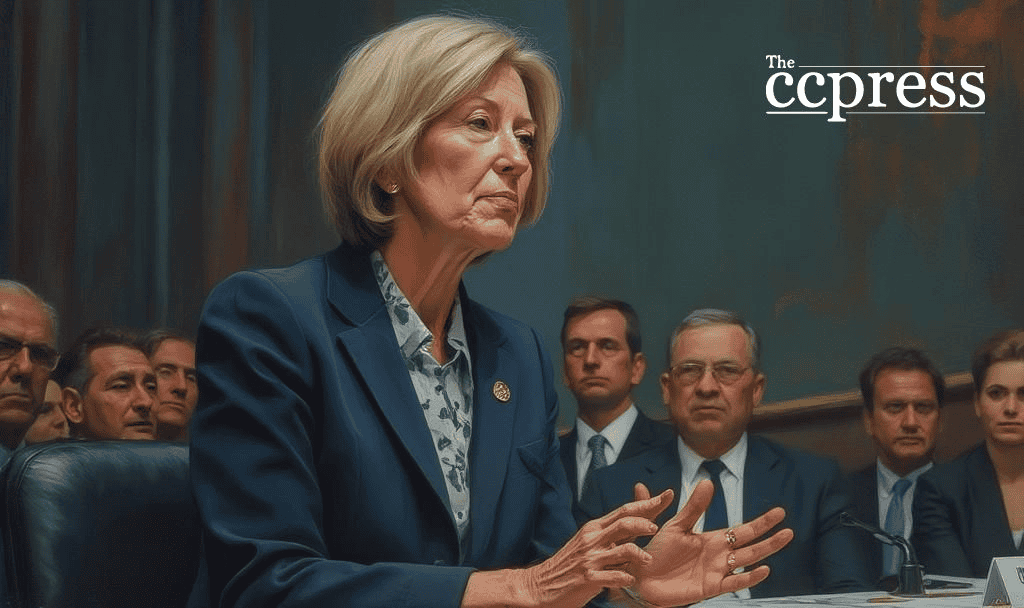

Mary C. Daly, President of the San Francisco Fed, signals potential multiple rate cuts in 2025 during public remarks on August 4, reflecting on U.S. economic conditions.

Daly’s openness to rate cuts highlights potential shifts in U.S. monetary policy, impacting financial markets and cryptocurrencies, prompting immediate stock rallies and anticipated crypto market movements.

Mary Daly of the Federal Reserve Bank of San Francisco has signaled openness to rate cuts in 2025. She highlighted uncertainty regarding the timing and scale of these reductions, reflecting the continuing economic assessment by the Fed.

As a member of the Federal Open Market Committee, Daly’s remarks suggest more than two U.S. interest rate cuts might be necessary in 2025. She noted the importance of responding to potential labor market constraints and inflation trends. “We may do fewer than two cuts. The more likely thing is we need to do more.” – Mary C. Daly, President, Federal Reserve Bank of San Francisco.

Financial markets reacted positively to Daly’s statements. Anticipation of potential rate reductions has spurred investor interest, with U.S. stock indices rallying on the news. Notably, major tech shares performed well due to these expectations.

Fed policy shifts traditionally impact various asset classes. Expectations of rate cuts tend to drive investments into risk assets, including cryptocurrencies. Mary Daly’s comments have significant implications for financial strategies in the near term.

Rate cuts can stimulate capital flows into digital currencies. This trend was observed in past cycles, where similar reductions led to significant crypto investments. Mary Daly’s insights could, therefore, herald promising market scenarios for digital assets.

Historical data reveals that lower interest rates often precede crypto asset rallies, involving increased liquidity across financial systems. This shift could bolster Bitcoin, Ethereum, and DeFi protocols, reinforcing investor confidence and market stability.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |