Binance P2P allows users worldwide to buy and sell crypto for their local currencies securely and directly. While millions of people trust the platform, scams still arise from careless trades. Knowing how fraudsters operate helps prevent financial loss and builds safer ways of trading.

Scammers try to use trust in users, pressure tactics, and fake proofs of payment to get traders to release their crypto without actually confirming transactions. Every user on Binance P2P will have to be properly taught to identify red flags, confirm all kinds of information, and rely only on platform-verified processes when trading.

| Key Takeaways – Binance P2P scams usually occur when traders release crypto without proper verification. – Always confirm payments directly in your bank account before marking trades complete. – Keep all chats, confirmations, and appeals within the Binance P2P for protection. |

What are Binance P2P scams?

Binance P2P scams are fraudulent practices with the intention of making a user lose funds in a peer-to-peer transaction. This mostly targets users who overlook simple verification steps or engage with fake traders masquerading as genuine.

The P2P model arranges real users for fiat transfers, not Binance. Because the fiat payments are outside of the direct control of Binance, scammers take this gap to send them a fake receipt, third-party transfer, or impersonate verified users.

Common Scam Types & How They Work

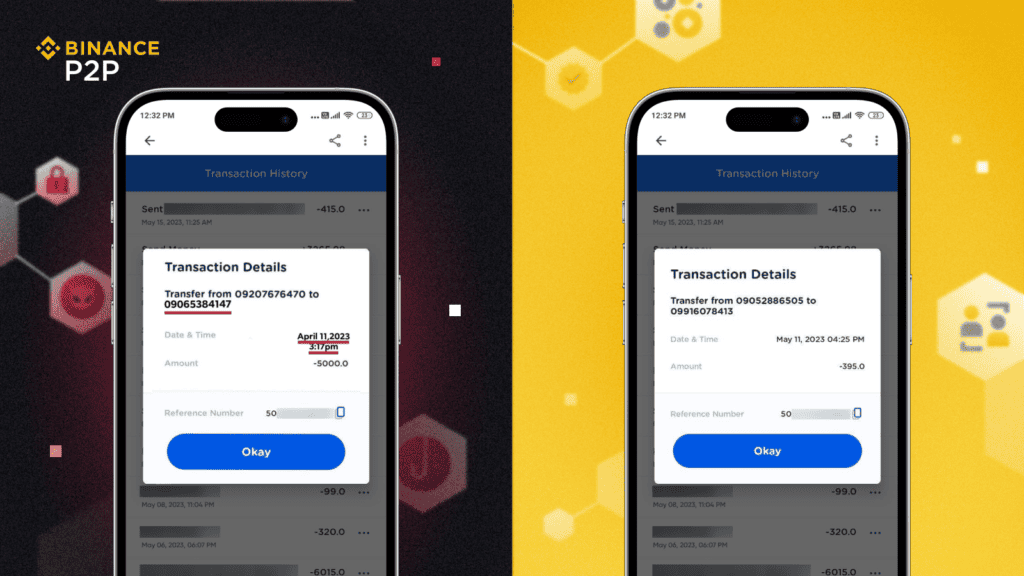

Proof of Payment Scams

Proof of payment scams usually involve fabricated confirmations of transactions with the purpose of coercing sellers. Scammers send edited screenshots or bank slips claiming to have made a payment and then request the cryptos.

Because once the crypto is transferred, victims do not find any record of such a payment. This scam works because the victim trusts visual proof over actual account balances. How to protect yourself:

- Always log on to your official banking application to verify deposits.

- Never rely on screenshots, e-mails, or chat claims.

- Release crypto only when payment actually appears in your account.

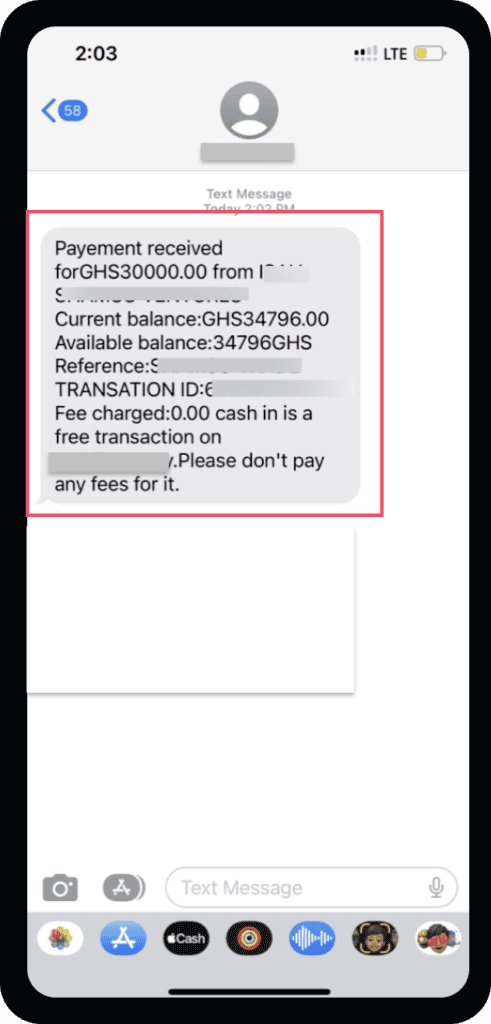

SMS Scams

In SMS fraud, fraudsters send fake text messages in the form of bank notifications. The message informs the seller that the amount has been deducted successfully, and the seller should dispatch the order.

It looks just like a real message, which makes it so believable. Victims rarely seek verification and lose the money in an instant. How to avoid it:

- Verify each payment in your bank account personally.

- Don’t rely on SMS or email notifications only.

- Avoid clicking any link contained in these messages.

Chargeback Scams

Chargeback scams occur when scammers reverse the payment after receiving the crypto. These usually happen with certain payment methods that allow refunds or cheque deposits.

Once the chargeback request goes through, your crypto is gone, and the scammer receives their fiat. Binance P2P cannot reverse external bank transactions. How to stay safe:

- Only accept payments from verified accounts with Binance user names.

- Immediately return cheques and third-party transfers.

- If a payment seems suspect, open a dispute before releasing funds.

Man-in-the-Middle Scams

Man-in-the-middle scams involve three parties: a seller, a buyer, and a scammer who manipulates them both. The scammer masquerades as a merchant and connects two real users without their knowledge.

The seller releases crypto to one buyer while the scammer collects payment from another. Both innocent users lose money because all communication happened outside Binance P2P.

How to protect yourself:

- Communicate only through Binance P2P’s chat system.

- Never share bank details outside the platform.

- Refrain from responding to trade requests originating from social media or messaging applications.

Triangle Scams

A triangle scam usually involves two scammers that coordinate the order with the same seller to cause confusion. One sends partial payment, and at the same time, another marks the trade as “paid” with fake proof. The seller, considering both payments to be valid, releases the crypto amount twice. The scammers profit while the seller loses some valuable digital assets.

Prevention tips:

- Check that all the payments exactly match your pending P2P orders.

- Confirm the total amount in your account before releasing funds.

- Do not rely on payment proofs provided by the counterparty.

Binance Impersonation Scams

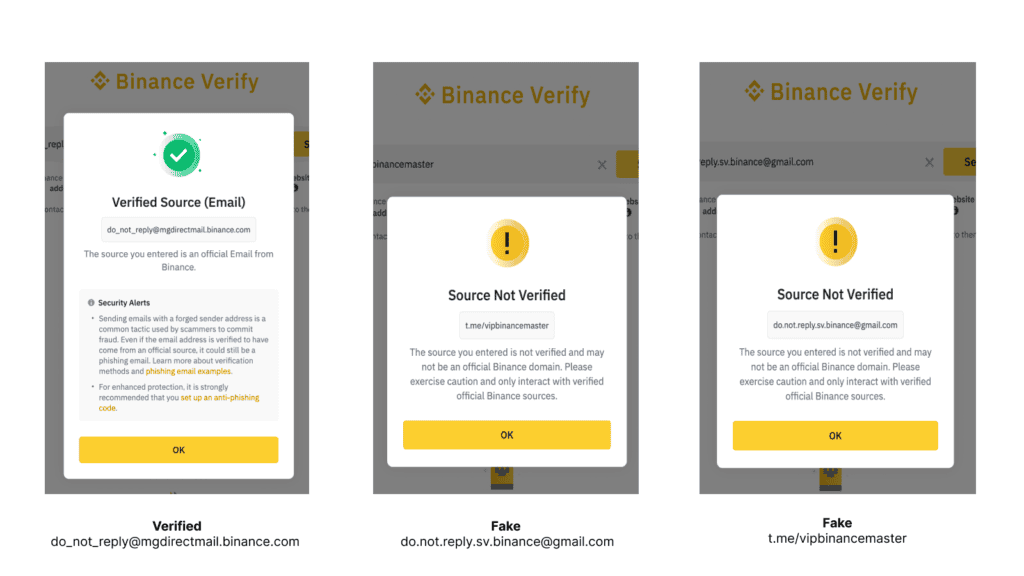

Imposter scams for Binance involve criminals who would fake themselves as the employees or support people of Binance. They manipulate users using fraud email addresses and authentic-looking chat messages.

They may indicate that the payment is secured via Binance and request that victims move funds to another wallet to confirm the release. If this is done, then the funds are irretrievable.

Stay protected:

- Binance will never request off-platform transfers or internal confirmations.

- Verify e-mail addresses using Binance’s official security verification webpage.

- Report any suspicious communication via Binance Support

Case Studies

In Nigeria, P2P trading on Binance became a hotspot for fraud and regulatory scrutiny. According to an analysis, “P2P trading in Nigeria had also become a hotspot for scams and fraud – including fake payment proofs, chargeback fraud, identity theft, and off-platform deals with no user protection.”

In one reported case, the U.S. Secret Service seized $1.5 million linked to a Nigerian fraudster’s Binance crypto account, including 7.239 BTC and 105.75 ETH among other assets.

In Brazil, authorities uncovered a cybercrime ring that laundered approximately R$ 164 million (≈ $30 million) through cryptocurrency transactions. Binance assisted São Paulo police in tracking the suspects who targeted crypto users via stolen devices and off-platform P2P deals.

A case from Hyderabad involved a scammer using a third-party payment account to complete a P2P order on Binance. The seller received confirmation from an unrelated account and released USDT before verifying the payer’s identity. The transaction was later reversed by the actual account owner, leaving the seller with no crypto or fiat compensation.

These verified incidents across Nigeria, Hyderabad and Brazil highlight a single truth: most Binance P2P scams exploit weak verification and off-platform communication. Staying inside Binance’s secure system and following strict payment checks remain the most effective ways to protect yourself and your crypto assets.

Best Practices / How to Protect Yourself

| Step | Action | Why It Matters |

|---|---|---|

| 1 | Verify KYC and trading history | Trusted users reduce scam risk |

| 2 | Keep all chats within Binance P2P | Binance can verify disputes |

| 3 | Confirm bank payment directly | Screenshots can be forged easily |

| 4 | Refuse third-party or cheque payments | Violates Binance policy |

| 5 | File an appeal if uncertain | Binance moderators can freeze funds |

The safest P2P traders are those who verify every step, avoid external communication, and remain patient during trades. Before completing any Binance P2P transaction, always confirm the counterpart’s identity and payment source.

New traders should start small, trade only with verified merchants, and focus on building experience before increasing volume. Experienced users should never get complacent; scammers often target confident traders through psychological manipulation.

What to Do If You’re Scammed

- Step 1: Go to your P2P order page and click “Appeal”.

- Step 2: Collect all transaction records, screenshots, and chat messages.

- Step 3: Contact Binance Support with complete order details.

Binance moderators will review the case and hold assets if possible. Quick response increases your recovery chances. Always cooperate and provide full evidence to support your claim.

If your funds are unrecoverable, report the case to local authorities. Submitting accurate information may help others avoid similar scams. Binance also monitors reports to identify recurring fraudulent accounts.

Recovering crypto after a scam is extremely difficult because of blockchain anonymity and cross-border transactions. Banks often consider these incidents as civil matters rather than criminal cases.

International cooperation is possible but slow. While Binance assists in investigations, prevention remains the only guaranteed protection for P2P traders. Staying informed is the most effective defense.

Conclusion

The one thing all Binance P2P scams have in common is misplaced trust. Fraudsters use urgency, distraction, or misplaced confidence to their advantage when scamming traders. Vigilance is the best defense. Verifying transactions, staying on-platform, and following the security protocols are the most effective ways users can protect their funds. Safe trading isn’t luck; it’s discipline implemented into every transaction.

FAQs

1. Can I recover funds lost to a Binance P2P scam?

Recovery is rare once crypto leaves your wallet. However, filing an appeal and reporting the scam to Binance may help prevent others from being targeted.

2. Is Binance P2P safe for beginners?

Yes. Binance P2P is safe when users verify payments, avoid third-party accounts, and communicate only through official channels.

3. How can I confirm that an email or message is from Binance?

Always check the sender’s domain via Binance’s official verification tool. Binance never asks for passwords or wallet transfers.

4. What’s the best way to stay protected on Binance P2P?

Verify every transaction step, trade only with verified users, and confirm all payments through your bank app before releasing crypto.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |