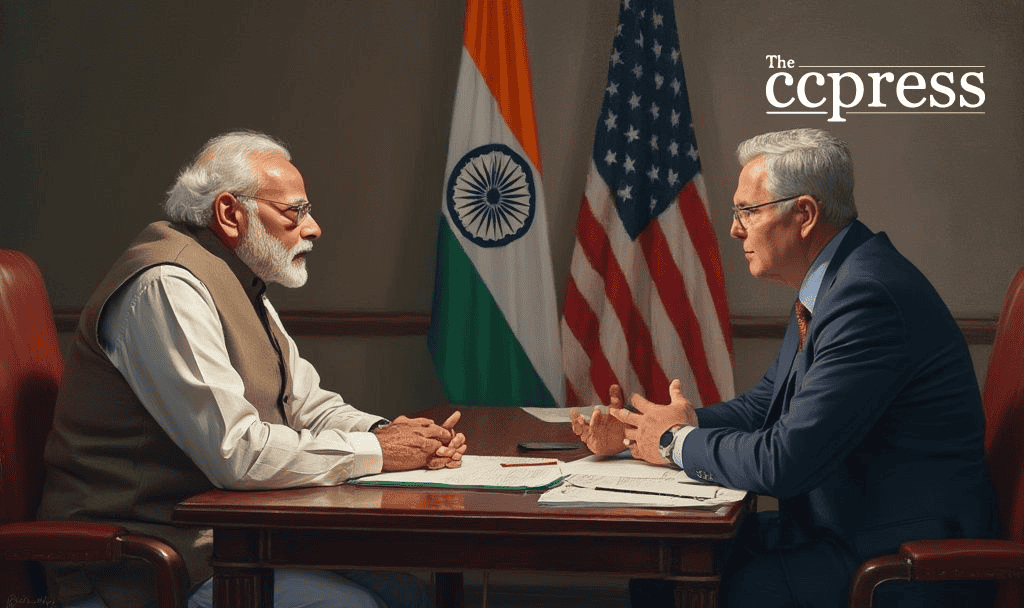

- Main event: India-U.S. trade negotiations with significant involved leadership.

- Potential $500 billion trade target by 2030 discussed.

- Discussions on tariff impacts on digital assets like Bitcoin.

The trade talks between India and the U.S. aim to mitigate tariff effects and expand bilateral trade. Immediate market reactions are minimal, but digital assets like Bitcoin and Ethereum remain sensitive to broader economic uncertainties.

The trade negotiations are led by Prime Minister Narendra Modi and U.S. Trade Representative Jamieson Greer, focusing on reducing reciprocal tariffs. Modi emphasized careful evaluation to achieve a beneficial outcome for both nations.

“The government is carefully evaluating the implications of U.S. tariffs and is committed to securing a win-win solution for both nations.” – Narendra Modi, Prime Minister of India

Tariffs imposed primarily on physical goods could indirectly impact digital markets. Bitcoin and Ethereum prices remain stable at present, though volatility is possible. Trade policies will indirectly affect sectors tied to bilateral exchanges such as those affected by the modification of beneficiary developing countries under the Trade Act.

Economic dialogue targets doubling trade flows, significantly impacting investments. Accurate assessments and compromises are sought to sustain economic relations, targeting a $500 billion trade objective by 2030. Past tariff adjustments led to trade tensions; negotiations focus on resolving these issues. Historical precedents include the 2019 termination of India’s GSP benefits. Outcomes could influence digital markets if integrating innovative trade tools.

Further negotiations may lead to financial and technological implications, potentially enhancing blockchain technology in trade processes. Historical trends highlight the need for careful diplomacy, given previous challenges in reaching agreements.