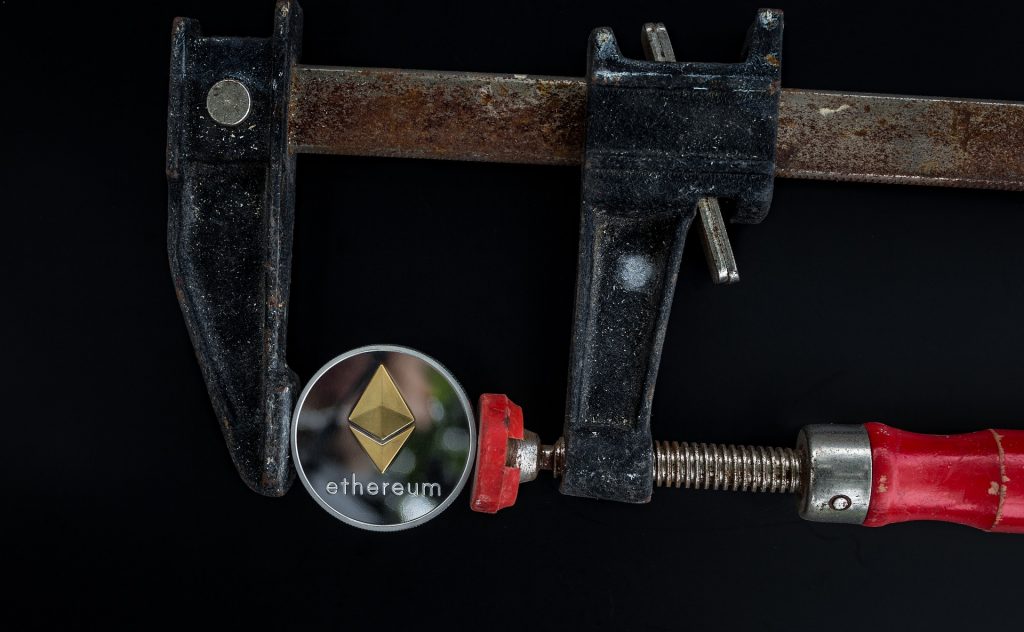

During the weekend, the Ethereum (ETH) network experienced some heavy congestion, prompting many to speculate that this was the result of orchestrated spam transactions. Gas prices went up and above 200 GWei for higher speeds.

“The Gas price in the Ethereum network has increased significantly, sometimes reaching more than 200 Gwei. Source: https://t.co/hE126OmuMe pic.twitter.com/4kQ5zAC3PU.”

– ICO Drops (@ICODrops) July 15, 2018”

The Ethereum gas station afterward managed to stabilize its gas prices, charging 9 GWei for the fastest transactions, and $0.047 on average for a transaction.

The iFish contract continues to issue token transactions, the gas price remaining unaffected for now. There was a time when the smart contract required as much as 40% of gas prices. According to a Reddit user called probablynotarussian, the successive transfer of tokens shows that the gas cost reached nearly 50 Ethereum per hour, keeping this trend for around a day.

The iFish smart contract was also linked to one suspicious address, which stored large amounts of EOS for months, which were then most likely transferred and converted in a new token. However, such a high quantity of EOS on the network made some suspect that there was an intentional effort which worked to spam the Ethereum network, leading to the congestion.

One theory regarding this would involve the donated EOS being converted into Ethereum, which was then used to in circular transactions, thus producing fake volume, driving transaction fees higher and making the network run slower.

The congestion followed a previous big gas price spike on July 2, when fees for one transaction reached at one point 5 ETH. ICO smart contracts are usually to blame for traffic congestions, compared to distributed applications.

Ethereum transactions usually are situated around 550,000 in 24 hours, the regular level being around 10 times more than what transaction are on the Bitcoin network. The constant shifting of tokens and the high fees are not in contravention with the network ’s rules – it just relocated transactions from other users.

The other possible factor could be a type of “growth hacking”, which is used to give tokens, smart contracts, or distributed exchanges more exposure, make them seem legitimate with a high number of transactions.

The Ethereum congestion occurred a few days apart from the IQ token distribution on the EOS network by the Evripedia project, which became one of the most notable networks based on its daily transaction volume.

However, the Ethereum network functions quite differently, having thousands of miners, as opposed to only 21 block producers, and features different speed limits.

ETH is currently trading at around $476 USD after it experienced a few minor drops, but it was not that affected by the network congestion, due to trading not depending on blockchain transactions.