- Polymarket shows a 98% chance Fed rates stay unchanged.

- Traders speculate on possible 25 basis point rate cut.

- Potential recession and tariffs affecting economic sentiment.

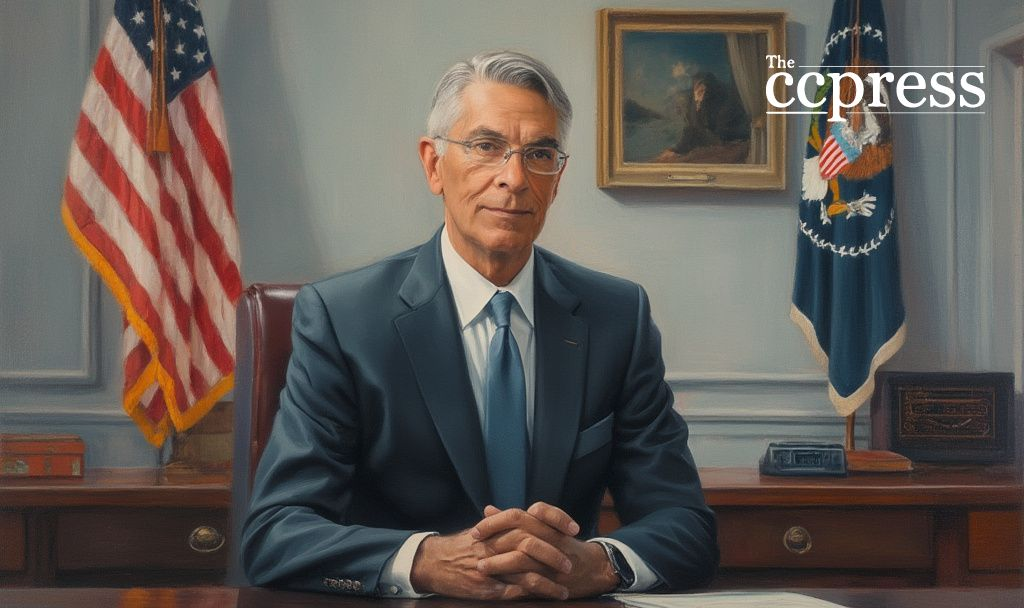

The Federal Reserve, led by Chairman Jerome Powell, is anticipated to maintain current interest rates at today’s meeting, with Polymarket users indicating a 98% chance of stability.

Polymarket’s prediction of unchanged rates reflects a cautious approach amid economic headwinds and political tensions, hinting at lingering uncertainties in market stability.

Market Consensus

The 98% likelihood, as determined by Polymarket, indicates strong market consensus on rate stability. The platform has reported significant trading volume of $71,360,576 on the event. Economic pressures, including potential recession and tariff impacts, pose challenges for rate adjustments.

Jerome Powell’s Stance

Federal Reserve Chairman Jerome Powell’s stance suggests hesitancy toward rate reduction amid ongoing political disputes. A trader has wagered $7,000 on a rate decrease, aiming at a substantial gain should a 25 basis point cut occur.

Wider Economic Impact

The decision’s impact spans financial markets, industries, and consumer confidence, pointing to continued economic uncertainty. Polymarket’s consensus supports a “cautious wait-and-see approach,” with low probability for drastic rate shifts.

Economic Conditions and Rate Predictions

Economic conditions, including tariff-induced slowdowns, make rate cut predictions less likely. Past meeting patterns show stability, suggesting continued inaction at this meeting. Polymarket offers markets on projecting 2025 rate changes, emphasizing ongoing uncertainty in forecasts. In the words of a Polymarket Data Analyst, “The strong market consensus (98%) against any rate change reflects trader sentiment that the Fed will continue its cautious wait-and-see approach.”

Strategies and Market Sentiment

While Powell faces pressure over Fed strategies, Polymarket’s data and trader sentiment favor a rate hold, highlighting a broader belief in consistent monetary policy despite complex economic landscapes.

Insightful Outcomes

Polymarket’s outcomes, alongside the Fed’s rate management practices, signal critical insights for industries reliant on interest rate trends, with economic variables shaping financial directions and regulatory responses.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |