- BITCOIN Act aims for a million BTC reserve over five years.

- Supported by Senator Lummis, Begich, and Trump.

- Targets managing U.S. debt through Bitcoin adoption.

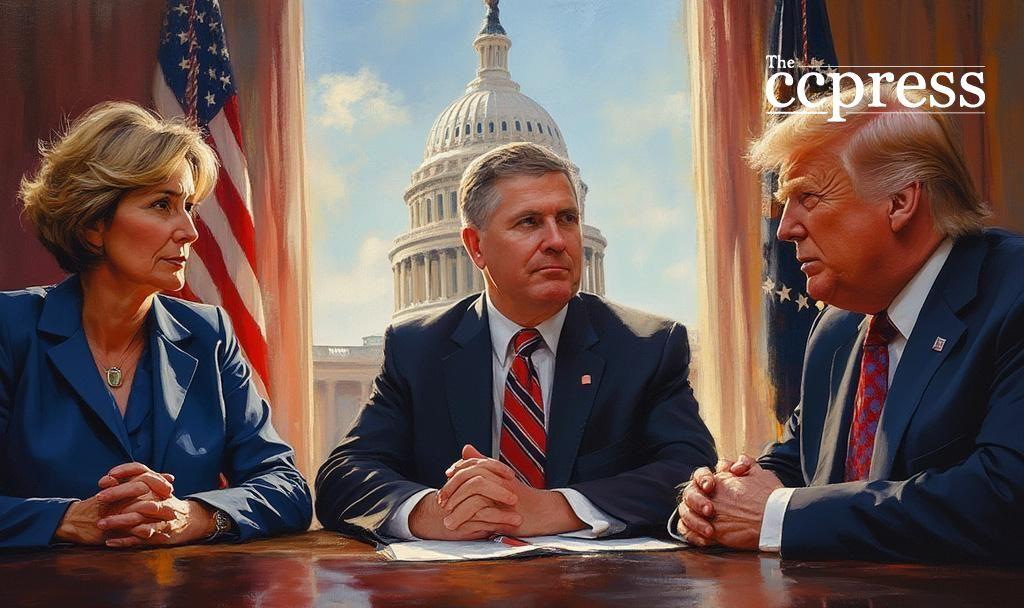

Senator Cynthia Lummis suggests establishing a Bitcoin strategic reserve to tackle the U.S. national debt, supported by Congressman Nick Begich and former President Trump, as part of the proposed BITCOIN Act of 2025.

Introduction of the BITCOIN Act

Senator Lummis and Congressman Begich submitted the BITCOIN Act to purchase 200,000 Bitcoin annually for five years, creating a 1,000,000 BTC reserve. Lummis highlighted Bitcoin’s potential to manage the $36 trillion U.S. debt.

Political Support for the BITCOIN Act

The proposal targets Bitcoin, emphasizing its strategic reserve value. Support from Donald Trump underscores the initiative’s political backing. Market reactions anticipate notable liquidity increases and valuation impacts on Bitcoin.

Implications for Bitcoin as a Reserve Instrument

Implementing this strategy could result in significant shifts in how digital assets are perceived as reserve instruments. Potential ripple effects might influence other cryptocurrencies and market confidence. The BITCOIN Act’s main goal is to leverage Bitcoin against national debt.

Global and Market Reactions

Analysts view this as a transformative move if passed. While similar steps have been attempted in smaller economies like El Salvador, no major economy has adopted such an extensive Bitcoin acquisition strategy. Experts anticipate increased market demand for Bitcoin, with notable implications for the U.S. financial landscape. Senator Cynthia Lummis emphasized, “The BITCOIN Act is the only solution to our nation’s $36T debt,” and added, “I’m grateful for a forward-thinking president who not only recognizes this, but acts on it.” Source

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |