- Main event: South Korea advancing stablecoin legislation.

- Leadership change: President Lee Jae-myung’s crypto-friendly policy.

- Financial shifts: Potential increase in local digital currency issuance.

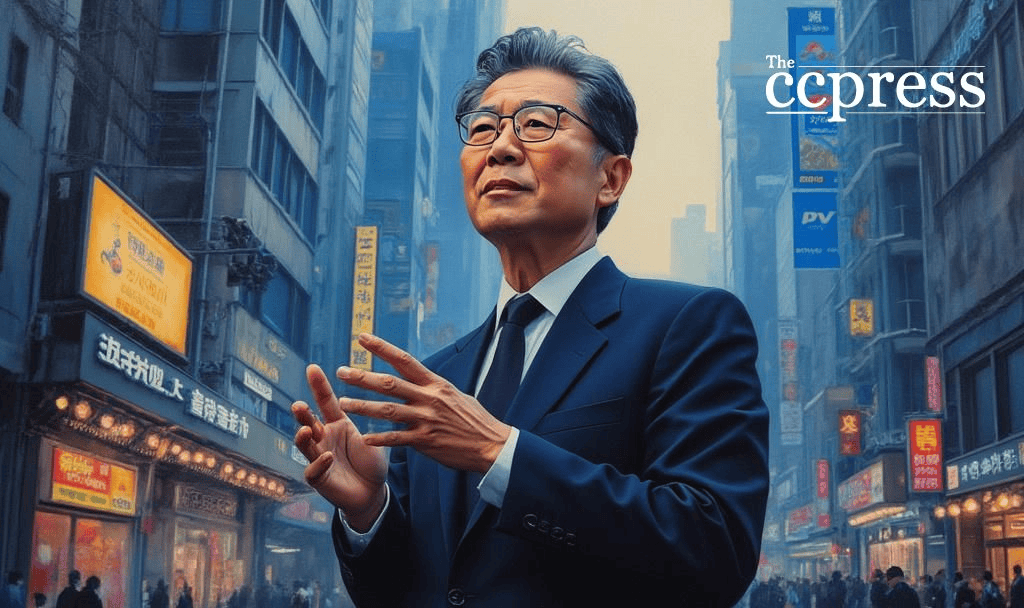

Lee Jae-myung, South Korea’s president, plans to introduce a bill enabling firms to issue stablecoins, with measures aimed at preventing national wealth leakage, according to local reports.

South Korea’s move to regulate stablecoin issuance underscores its ambition to boost digital currency integration and stimulate the crypto market, aligning with global regulatory trends.

We need to establish a won-backed stablecoin market to prevent national wealth from leaking overseas. – Lee Jae-myung, President, Republic of Korea

President Lee Jae-myung has pushed for this bill shortly after taking office. His administration supports digital assets and aims to implement a won-backed stablecoin market. The proposed legislation requires issuers to have 500 million won in equity capital and regulatory oversight from the Financial Services Commission (FSC).

The proposed law’s immediate effects could boost South Korea’s crypto market, establishing it as a leading global player. There is potential for increased local stablecoin issuance, improving trust and market confidence among domestic investors.

The bill’s broader implications could affect the financial sector, introducing regulatory clarity and encouraging legitimate stablecoin use. It may boost institutional involvement, particularly through platforms supporting new won-pegged stablecoins, impacting economic dynamics and investment strategies. Markets may witness a rise in domestic DeFi activity due to enhanced regulatory frameworks favoring stablecoin growth.

Insights derived from historical trends suggest a potential increase in investor confidence and stablecoin liquidity. This regulatory approach could invigorate South Korea’s crypto economy while reinforcing global market connectivity through assets like BTC and ETH, fostering more robust crypto-adoption pathways for institutional players.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |