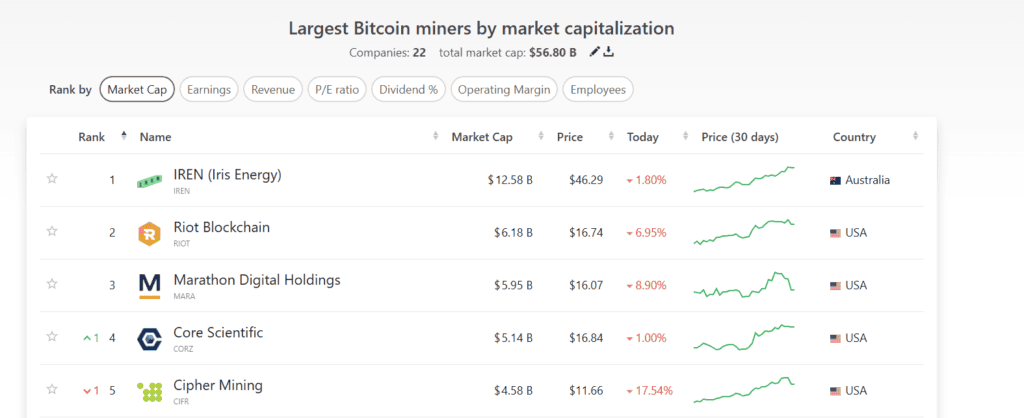

The five largest Bitcoin mining companies today dominate a significant portion of the cryptocurrency infrastructure. They are not just reflections of Bitcoin’s price swings but also indicators of how technology, energy strategy, and global regulations shape the mining industry. Investors looking into this space must examine numbers, operational capacity, and long-term goals before making decisions. The table below provides a quick snapshot before diving deeper into each company’s operations and positioning.

Quick Comparison of the Top 5 Bitcoin Mining Companies

| Company | Market Cap (Billion USD) | Current Hashrate (EH/s) | BTC Mined/Year (Est.) | Share Price (USD) | Main Energy Source | Expansion Target |

|---|---|---|---|---|---|---|

| Iris Energy (IREN) | 12.58 | ~7 | ~3,500 – 4,000 | 46.29 | 100% renewable hydropower | 10 EH/s, ESG carbon-free |

| Riot Blockchain (RIOT) | 6.18 | ~10 | ~5,000+ | 16.74 | Low-cost Texas grid, flexible load | 15 EH/s by 2026 |

| Marathon Digital (MARA) | 5.95 | ~9 | ~4,000 | 16.07 | Wind and natural gas | 12 EH/s, cut energy costs 30% |

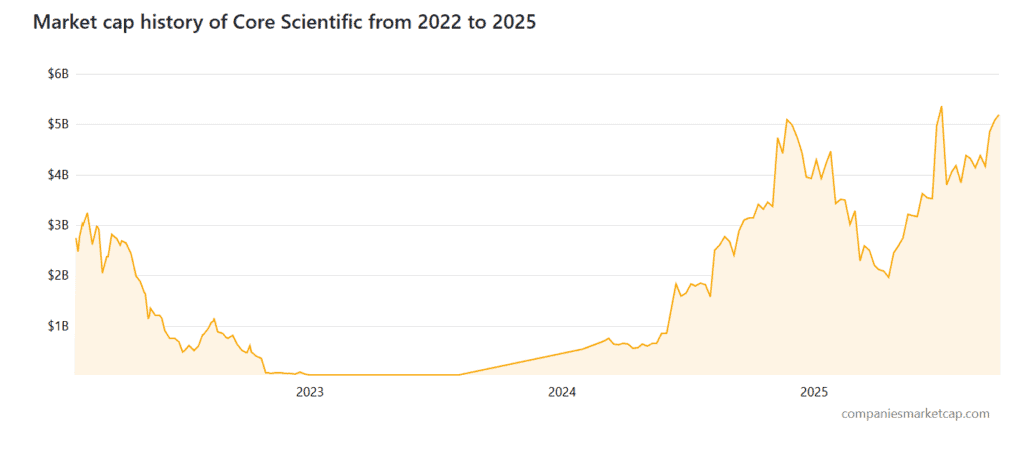

| Core Scientific (CORZ) | 5.14 | ~8.5 | ~3,500+ | 16.84 | Mixed renewable + conventional | 11 EH/s, expand hosting |

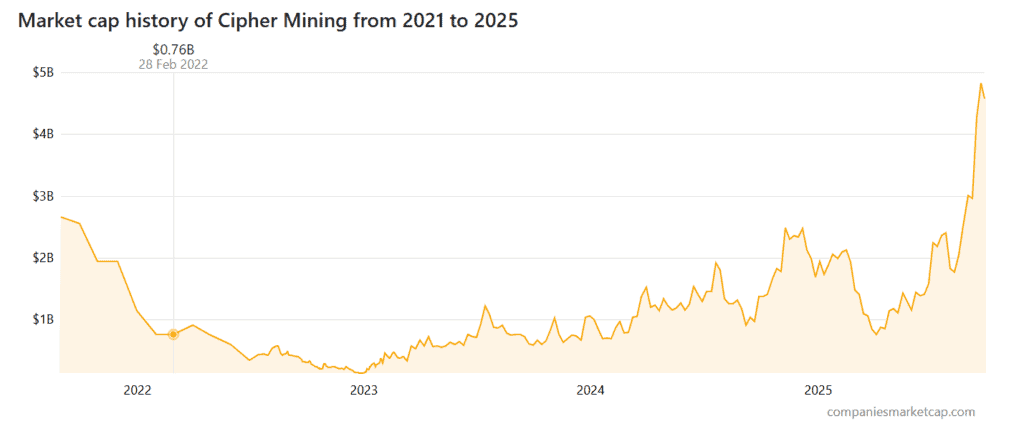

| Cipher Mining (CIFR) | 4.58 | ~6 | ~2,000+ | 11.66 | Wind and solar | 10 EH/s by 2026, 70% clean |

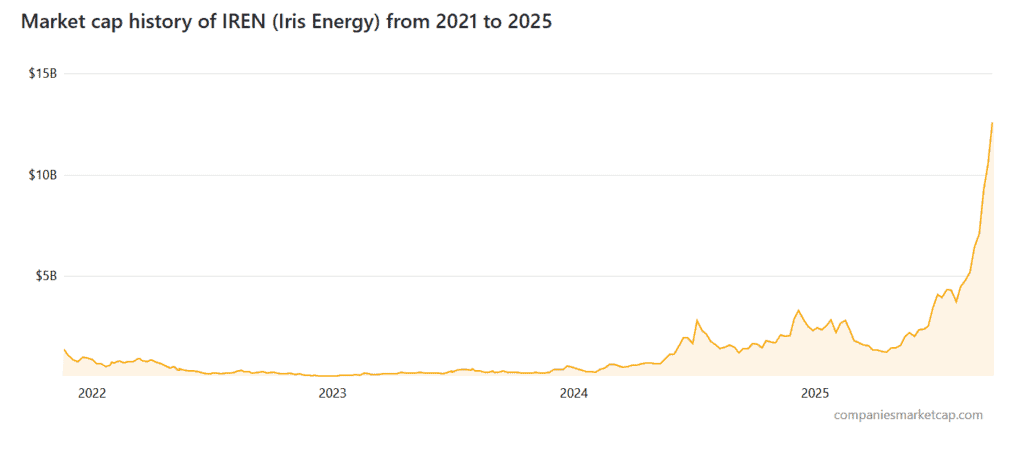

1. Iris Energy (IREN): The Benchmark for Green Bitcoin Mining

Iris Energy leads the sector with a market cap of $12.58 billion, positioning itself as a pioneer in “green mining.” The company operates large-scale data centers in Australia and Canada, powered entirely by renewable hydropower that eliminates CO₂ emissions.

By adopting immersion cooling technology, Iris Energy reduces power consumption, extends equipment lifespan, and cuts electronic waste. Its current hashrate stands at ~7 EH/s, translating into 3,500–4,000 BTC mined annually with near-perfect uptime.

On the financial side, IREN shares trade at $46.29, up almost 30% over the past month despite a 1.8% pullback in the most recent session. Looking ahead, Iris Energy aims to expand its capacity to 10 EH/s within two years while maintaining ESG-certified carbon neutrality, a strategy designed to attract sustainable investment funds and cement its leadership as the industry’s benchmark for clean Bitcoin mining.

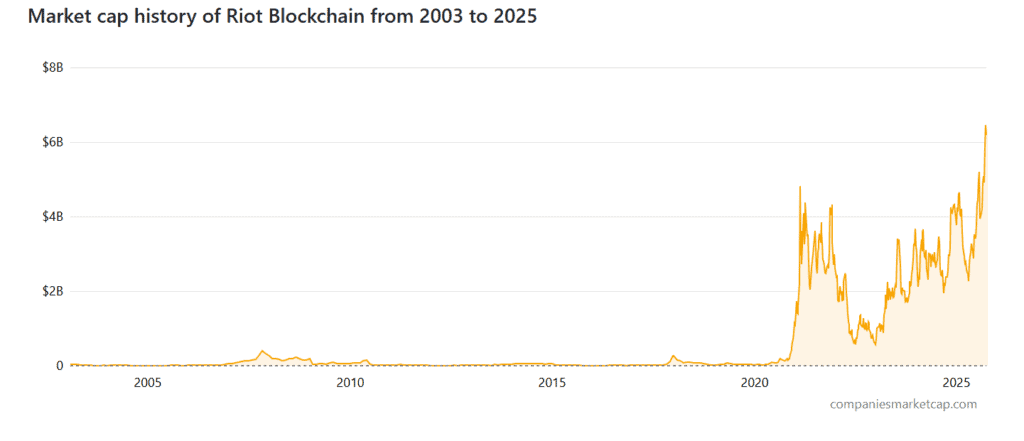

2. Riot Blockchain (RIOT): North America’s Cost-Efficient Mining Giant

Riot Blockchain, with a market cap of $6.18 billion, is the largest Bitcoin mining company in North America and second worldwide. The firm anchors its operations in Texas, where access to low-cost electricity and flexible energy programs supports large-scale data centers. By integrating load-balancing systems tied to the state’s power grid, Riot minimizes operational costs and even generates additional income through grid participation.

With a current hashrate of ~10 EH/s, the company mines more than 5,000 BTC annually and consistently benefits from Texas’ unique energy framework. RIOT shares are priced at $16.74, dropping 6.95% in the latest session but climbing nearly 20% over the past month. Riot’s strategic roadmap includes boosting capacity to 15 EH/s by 2026 and building new facilities across the U.S., ensuring lower per-BTC costs and reinforcing its reputation as a cost-efficient market leader.

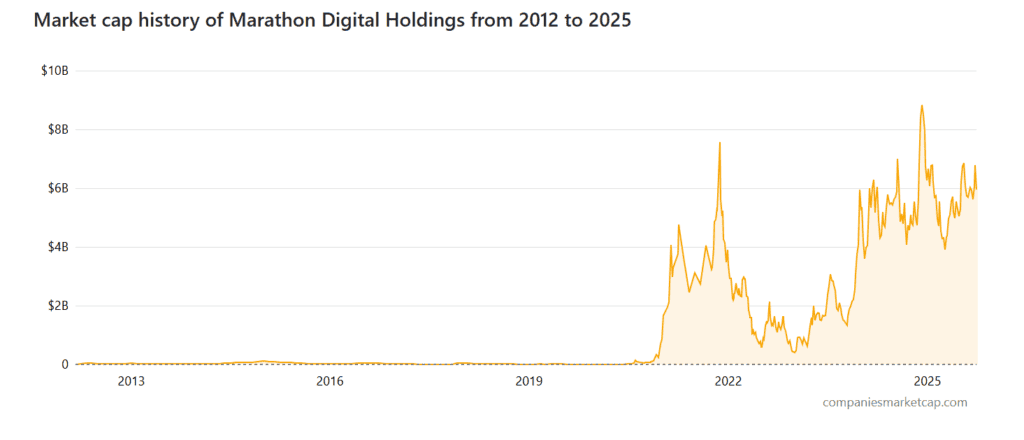

3. Marathon Digital Holdings (MARA): Rapid Expansion with High Volatility

Marathon Digital, valued at $5.95 billion, has become known for its rapid expansion and large-scale mining operations. Its facilities are distributed across multiple U.S. states, powered mainly by a mix of wind and natural gas.

Marathon invests heavily in next-generation ASIC hardware, designed to maximize energy efficiency and reduce operational expenses. Currently, the company commands a hashrate of ~9 EH/s, which translates to over 4,000 BTC mined per year.

On the stock market, MARA trades at $16.07, reflecting an 8.9% daily loss but an impressive 25% gain over the past 30 days, underscoring both volatility and growth potential. Marathon’s expansion plan sets a target of 12 EH/s within the next two years, alongside a commitment to lower energy costs by at least 30% per BTC mined. This dual strategy—scaling up while driving down costs—positions the company as a strong contender for the number one spot in the U.S. mining landscape.

4. Core Scientific (CORZ): Diversified Model for Stability and Growth

Core Scientific, with a market cap of $5.14 billion, is regarded as one of the most stable and diversified players in the mining industry. What sets the company apart is its hybrid model: it not only mines Bitcoin but also offers hosting services for third-party clients. This diversification provides a more consistent revenue stream, less dependent on Bitcoin’s price cycles.

Operating across multiple states in the U.S., Core Scientific leverages a balanced mix of renewable and conventional energy sources. The company’s current hashrate is ~8.5 EH/s, enabling the production of over 3,500 BTC per year.

CORZ stock trades at $16.84, with only a 1% dip in the last session, reflecting relative stability compared to peers. Future plans include raising hashrate to 11 EH/s and significantly expanding hosting services to attract enterprise clients, while maintaining transparent ESG commitments that enhance its appeal to institutional investors.

5. Cipher Mining (CIFR): The Next-Generation Renewable Min

Cipher Mining, with a market cap of $4.58 billion, is the youngest among the top five yet has quickly gained attention through aggressive scaling. Its data centers in Texas and Ohio rely primarily on wind and solar energy, aligning the company with the renewable-first trend.

Cipher’s modular mining center design allows highly flexible expansion, adapting capacity to market conditions more efficiently than traditional facilities. At present, Cipher operates with a hashrate of ~6 EH/s, mining roughly 2,000 BTC annually. On the financial side, CIFR shares trade at $11.66, down 17.54% in the latest session—a sharp drop that highlights short-term risk.

Nevertheless, Cipher remains ambitious, aiming for 10 EH/s by 2026 while keeping renewable energy usage above 70% across its portfolio. This focus positions the firm as a “next-generation green miner” with long-term potential despite immediate volatility.

Risk Outlook

While the top mining companies offer high upside, investing in them also carries significant risks. The most pressing factor is Bitcoin’s price volatility: during bull markets, profits soar, but during downturns, revenues can collapse by 60–80%.

Regulatory pressure is another major challenge, as governments in the U.S., Europe, and China continue to tighten rules on energy use, carbon emissions, and taxation, which could raise costs or even force operational relocations.

Ultimately, Bitcoin mining stocks deliver outsized returns when the market rallies but also expose investors to steep losses in bearish cycles. For this reason, they are best suited to risk-tolerant investors with a long-term horizon.

Conclusion

The top five Bitcoin mining companies: Iris Energy, Riot Blockchain, Marathon Digital, Core Scientific, and Cipher Mining, represent both the promise and the uncertainty of the crypto industry. Each has its own approach: Iris with hydropower sustainability, Riot with cost efficiency in Texas, Marathon with rapid scaling, Core with a diversified model, and Cipher with renewable-driven growth. Together, they showcase how energy, regulation, and innovation define the future of Bitcoin mining. For investors, these companies offer a unique window into the evolving intersection of technology and finance, but one that demands careful risk management before entering.

FAQS

1. Which is the largest Bitcoin mining company today?

Iris Energy (IREN) is currently the largest Bitcoin mining company with a market cap of $12.58 billion, fully powered by renewable energy. The company runs large-scale data centers in Australia and Canada, achieving a hashrate of ~7 EH/s and producing around 3,500–4,000 BTC annually. Iris plans to expand to 10 EH/s within the next two years while maintaining ESG-certified carbon neutrality, positioning itself as the benchmark for sustainable Bitcoin mining.

2. What factors have the strongest impact on mining companies’ profitability?

Bitcoin’s price is the single most critical factor, directly driving revenue and profit. During bear markets, profits can drop by 60–80%. Beyond price, energy costs and regulatory pressures (such as ESG requirements, taxation, and carbon emission rules) also play a significant role in shaping operational expenses and long-term scalability.

3. Are Bitcoin mining stocks safer than buying Bitcoin directly?

Not necessarily, mining stocks often carry even higher risk than BTC itself. This is because they combine exposure to Bitcoin price volatility with additional factors like operational costs, energy strategies, and regulatory challenges. However, in bull cycles, mining stocks can outperform Bitcoin as companies scale capacity and reduce costs, making them appealing to high-risk investors who prefer equity exposure over holding BTC directly.

4. What makes renewable energy important for Bitcoin mining companies?

Renewable energy reduces costs, improves ESG compliance, and attracts institutional investors. Companies like Iris Energy and Cipher Mining rely heavily on hydropower, wind, and solar, cutting carbon emissions while ensuring long-term sustainability. This strategy not only lowers operating expenses but also aligns with global regulations, giving them an edge in securing capital from environmentally focused funds.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |