| Sponsored Content Notice: This piece was provided by a third-party sponsor and does not reflect the views or analysis of our editorial team. Please do your own research before making financial decisions. |

The cryptocurrency landscape now enters a more mature phase where discussions shift away from temporary market excitement. Investors increasingly prioritize foundational elements like infrastructure strength, network scalability, and sustainable narratives capable of enduring several market cycles.

Historical patterns reveal that the best crypto to buy ahead of significant market expansion rarely appears obvious initially. Typically, these projects work silently on perfecting their technology, timing their releases strategically, and building distribution networks while market attention fixates elsewhere.

Here are the Top 6 Cryptos To Watch 2026, selected through analysis of present momentum patterns, ecosystem advancement, and alignment with anticipated market directions.

1. Zero Knowledge Proof (ZKP): AI Blockchain Prioritizing Privacy

Zero Knowledge Proof gains recognition as one of 2026’s most fundamentally significant emerging projects. The platform operates on a straightforward yet impactful principle: sophisticated computational tasks, including AI processing, must allow verification while protecting underlying data exposure. Rather than adding privacy features later, ZKP embeds privacy directly into its core computational and verification architecture on-chain.

ZKP distinguishes itself from comparable emerging networks through its launch approach. The development team invested over $100 million from internal resources in constructing a complete infrastructure before initiating presale auctions.

This investment covered blockchain framework development, proof-of-work mechanisms, execution infrastructure, and operational testnet deployment. This approach inverts standard cryptocurrency development patterns where fundraising precedes building.

Additionally, ZKP implements extended presale auction mechanics instead of predetermined pricing or exclusive private distributions. Token allocation happens progressively across time, enabling organic price discovery through participation levels. Industry experts recognize this framework as healthier, minimizing early token concentration risks and avoiding abrupt supply disruptions.

Forecasts suggesting presale auctions might generate over $1.7 billion position ZKP among discussions of top crypto coin choices for investors exploring opportunities beyond conventional Layer-1 networks.

2. Solana (SOL): High-throughput Layer-1 Platform

Solana maintains a position among cryptocurrency’s most vibrant ecosystems. Through market fluctuations, the network continuously handles substantial DeFi transaction volumes, NFT activities, and consumer applications, leveraging minimal transaction costs and exceptional processing capacity. Blockchain analytics reveal long-term investors accumulating positions during downturns, a behavior historically signaling robust recovery phases.

Given its established developer community and expanding institutional adoption, Solana represents the best crypto to buy for investors wanting exposure to verified, heavily-utilized networks rather than experimental ventures. Its position as a performance-oriented Layer-1 solution ensures continued relevance approaching 2026.

3. Avalanche (AVAX): Scalable Smart-contract Platform

Avalanche’s subnet architecture provides distinctive positioning among smart-contract ecosystems. Rather than competing exclusively for common blockchain space, AVAX facilitates application-tailored chains optimized for gaming applications, financial services, and corporate implementations. This architectural flexibility attracts institutional entities investigating tokenization possibilities and proprietary blockchain environments.

Although price movements show inconsistency, Avalanche pursues steady development. Market analysts frequently identify AVAX as a top crypto coin carrying recovery potential should investment flows return toward scalable Layer-1 infrastructure throughout upcoming cycles.

4. Sui (SUI): Advanced Layer-1 network

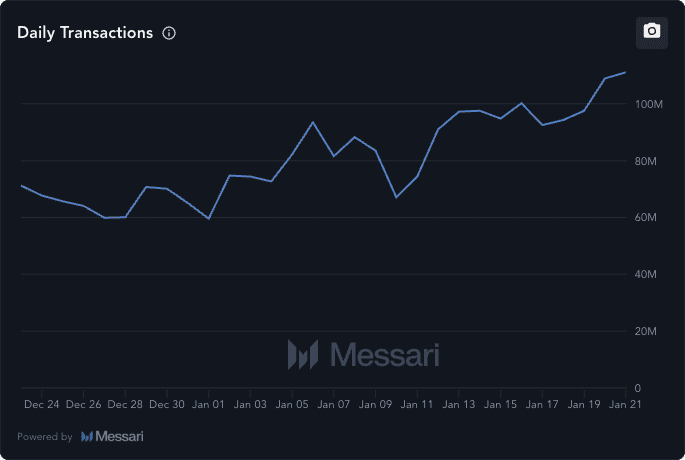

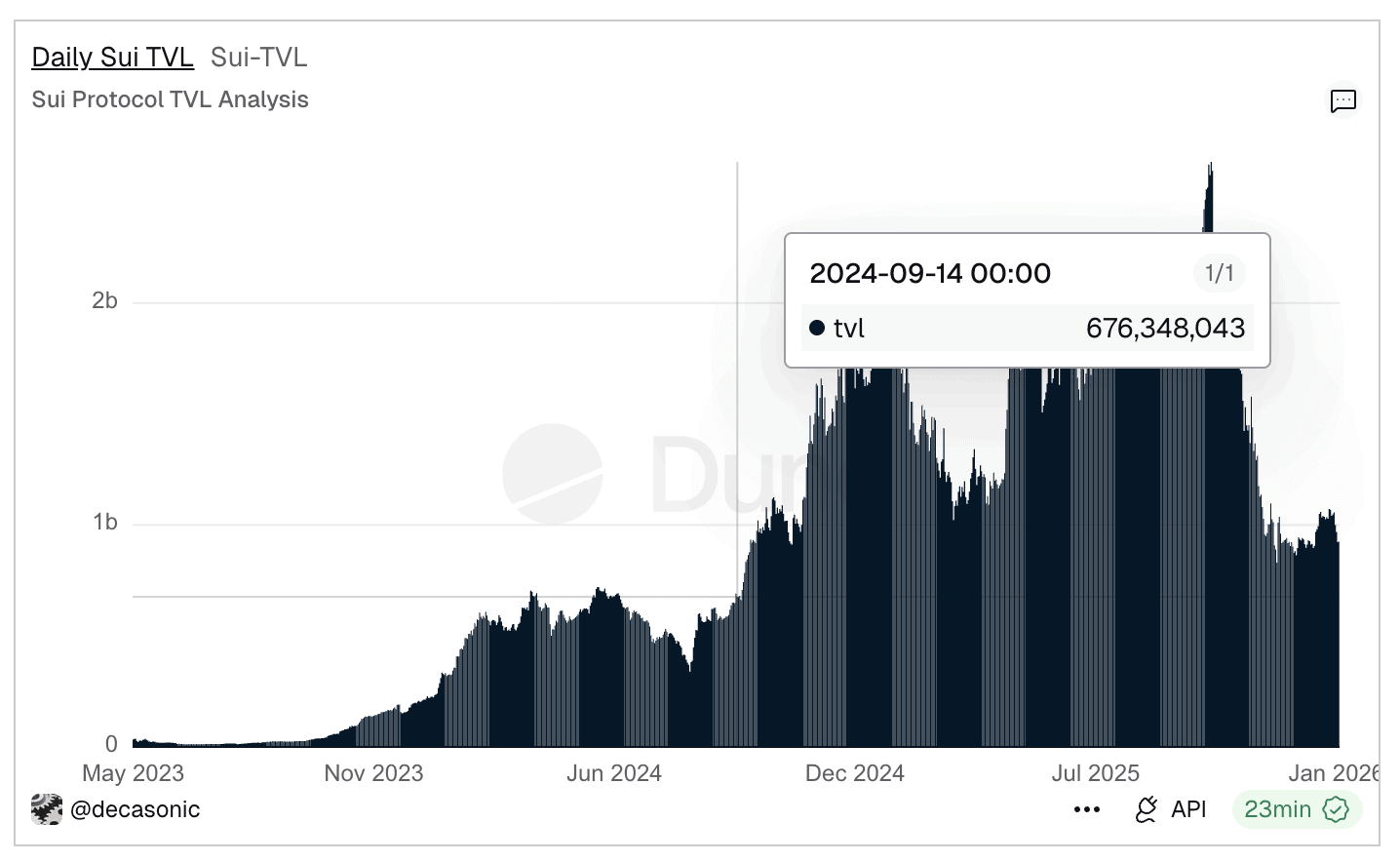

Sui receives attention for ambitious technical objectives. Engineered with parallel transaction processing and Move programming language, the platform targets applications demanding rapid response times and speed, including gaming platforms and instantaneous DeFi operations. Developer engagement continues expanding despite token valuations remaining significantly below previous peaks.

For investors pursuing elevated-risk, elevated-return opportunities, Sui appears frequently among Top 6 Cryptos To Watch 2026 discussions as a possible breakthrough contender if adoption metrics align with technical development plans.

5. The Sandbox (SAND): Metaverse & Creator-driven Economy

The Sandbox experiences revived attention as GameFi and virtual environments pursue their next evolutionary phase. Recent platform enhancements emphasize improved creator utilities, AI-integrated content generation, and reduced transaction expenses. Instead of depending on speculative virtual property transactions, the project advances toward sustainable creator-powered economic models.

Though maintaining cyclical characteristics, SAND retains recognition as a top crypto coin within metaverse discussions and frequently serves as an indicator for broader GameFi market sentiment.

6. Axie Infinity (AXS): GameFi & Digital Intellectual Property

Axie Infinity has transitioned from purely play-to-earn structures toward sophisticated gameplay and sustained IP cultivation. Emerging MMO-format experiences and restructured tokenomics target reducing speculative behavior while rewarding authentic player participation.

AXS gains from the wider GameFi resurgence and maintains inclusion in conversations surrounding the best crypto to buy within gaming sectors, predominantly due to established brand recognition and continuous development efforts.

Final Thoughts

The top 6 cryptos to watch 2026 mirror market maturation trends. From established networks like Solana to nascent infrastructure such as Zero Knowledge Proof, the unifying factor involves alignment with enduring trends rather than momentary excitement.

Historical evidence suggests the best crypto to buy typically emerges where fundamental strengths develop quietly before broader recognition arrives. For investors prepared to investigate beyond surface-level narratives, this selection provides a perspective on where such alignment potentially exists currently.

| Disclaimer: The text above is an advertorial article that is not part of theccpress.com editorial content. |