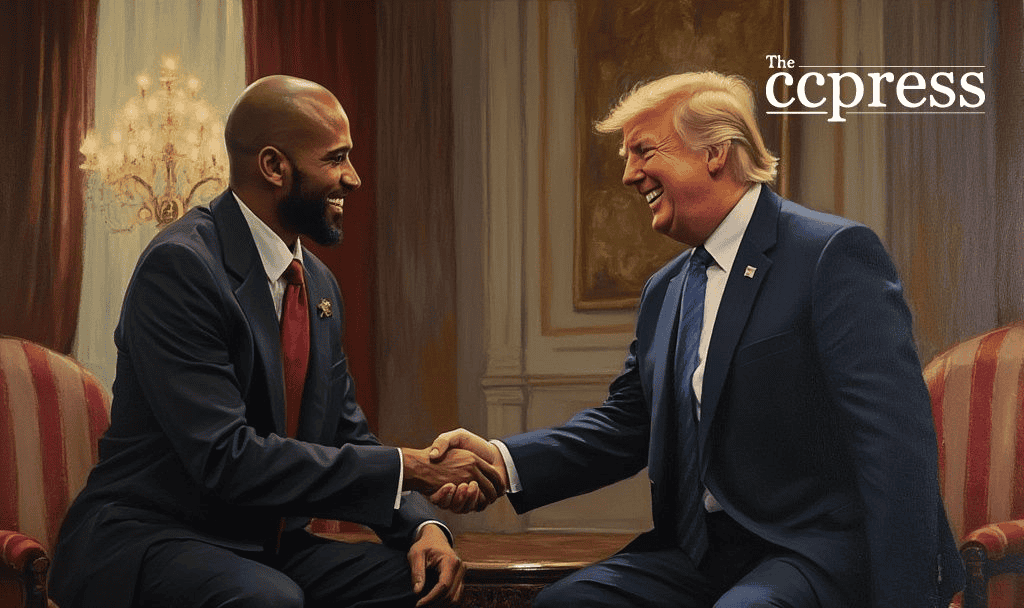

- Main event focuses on bilateral trade and Bitcoin discussions.

- Potential impact on Bitcoin market.

- Financial and security cooperation expected.

This meeting explores potential shifts in cryptocurrency regulation and international relations, with Bitcoin market speculations rising.

Bitcoin-friendly policies of President Bukele and discussions on border security and trade are central to the Trump-Bukele meeting. Historical precedents indicate that diplomatic exchanges can provoke market reactions.

US President Trump, known for immigration policies, and Bukele, an advocate for Bitcoin, are at the forefront. Actions under discussion include cooperative security measures and fiscal agreements focused on crypto.

“I commend Bukele’s efforts in housing the most violent alien enemies of the world in El Salvador’s prisons, emphasizing our continued collaboration against terrorism and crime,” stated Trump.

The Bitcoin market may respond to potential policy shifts discussed. Observers note that agreements might lead to shifts in El Salvador’s BTC investments. Bukele’s Bitcoin stance often influences cryptocurrency trends.

Financial, political, and social implications are notable. Trump’s evolving outlook on economic policies suggests a potential crypto market reshuffle. US-El Salvador cooperation on crime and trade underpins this diplomatic move.

Potential shifts include joint cryptocurrency initiatives and changes in US regulatory frameworks. Historically, Trump’s endorsements and Bukele’s decisions impact markets. On-chain data shows altered transaction patterns post-major announcements.

In-depth analysis shows shifts in El Salvador BTC bonds and increased US investment interest. Past economic discussions have propelled crypto market volatility. Joint efforts might streamline cryptocurrency regulations, reflecting in global crypto infrastructures.