- Key leadership shift and financial implications identified.

- Policy disagreements end joint ventures.

- Negative economic repercussions for Musk-led companies.

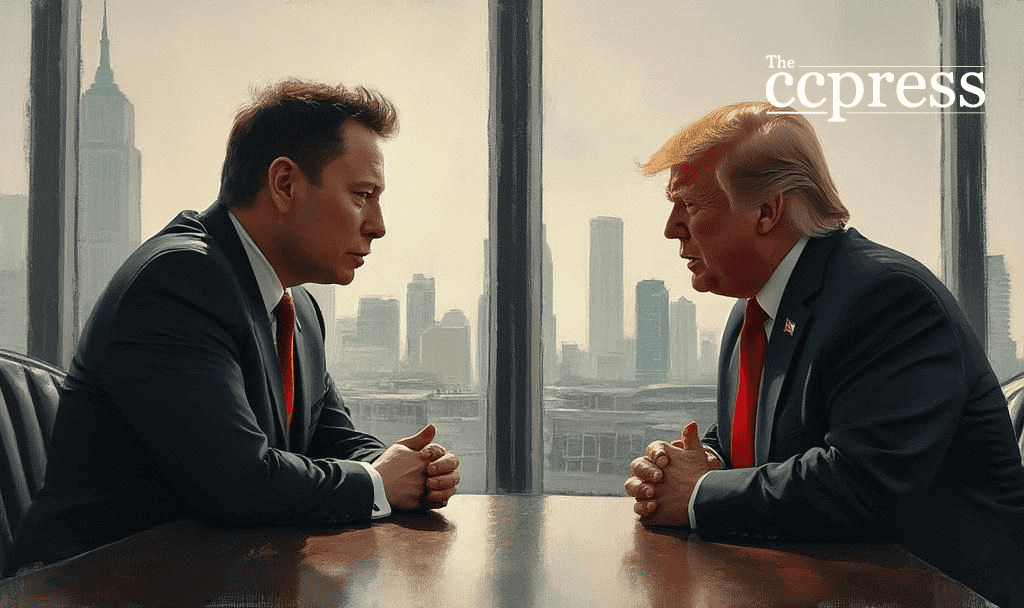

Tensions between Trump and Musk impact political dynamics and financial markets, prompting scrutiny over government-business relations.

Donald Trump and Elon Musk parted ways following disagreements over policy and leadership strategies. The U.S. President highlighted Musk’s dissatisfaction with federal spending, leading to the end of their collaboration.

The breakup impacts Tesla and SpaceX, with Trump canceling electric vehicle mandates and subsidies. This move signals a governmental shift away from prior commitments to Musk’s enterprises.

The impact on Tesla could affect associated markets, including suppliers reliant on federal contracts. This tension also raises questions about the future of U.S. innovation efforts.

Elon has ‘run out of steam,’ I asked him to leave, I canceled his electric vehicle mandate that forced everyone to buy electric cars that no one else wanted, and he just went crazy!” — Donald Trump

The leadership split between Trump and Musk emphasizes an ongoing debate concerning fiscal policy and corporate dependency on government subsidy. Observers focus on Tesla’s financial strategies to manage the new fiscal landscape.

Historical patterns suggest companies facing subsidy withdrawals generally reassess investment priorities. U.S. policy changes may influence market speculation, presenting opportunities for competitors. Tesla’s actions may further define industry responses.

The passage of a major bill in the House was a turning point, as discussed in a White House article.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |