- Venezuela to integrate Bitcoin and USDT into banking system.

- Integration led by Conexus, significant for local economy.

- Potential regulatory and market effects analyzed.

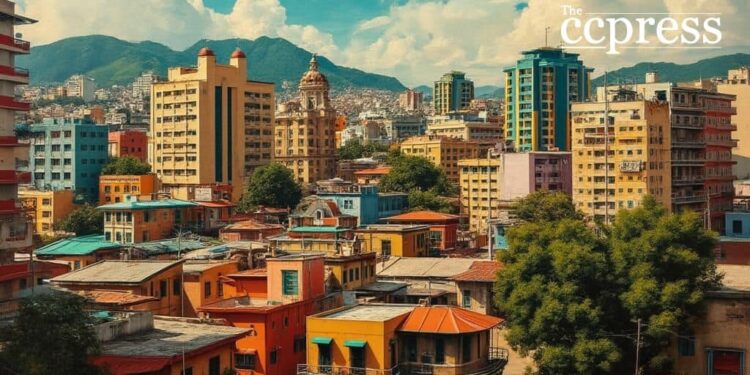

Venezuela plans to integrate Bitcoin and stablecoins into its national banking network by December 2025, led by Conexus, a major financial infrastructure provider.

This initiative signals potential shifts in the country’s financial landscape amid hyperinflation, offering regulated crypto services through traditional banking.

Venezuela Integrates Bitcoin into National Banking Network

Venezuela is integrating Bitcoin and stablecoins, notably USDT, into its national banking network by December 2025. This integration aims to stabilize economic challenges by offering digital assets through regulated banking channels.

Conexus, a major player in Venezuela’s financial infrastructure, is spearheading the initiative under the leadership of Rodolfo Gasparri. He stated that banks can soon offer stablecoin services with proper regulation to address hedging needs. “People in Venezuela are using stablecoins for hedging, and now banks will be able to offer these services with proper regulation.” – Rodolfo Gasparri, President, Conexus

This move is expected to impact Venezuela’s financial landscape, potentially increasing regulated stablecoin deposits. The initiative aims to shift transactions from informal peer-to-peer platforms to regulated banking facilities, improving liquidity and financial oversight.

Economically, it addresses hyperinflation issues, while socially, it aims to attract investments into Venezuela’s crypto ecosystem. The potential increase in Bitcoin and stablecoin flows may boost banking sector activity and offer new financial services.

Unlike El Salvador’s 2021 move, Venezuela uses banking intermediaries to implement Bitcoin usage. This approach might provide a blueprint for inflation-hit economies looking to combine traditional banking with cryptocurrency advantages.

By leveraging Venezuela’s banking network, the integration could set the stage for further technological investments and innovations in the financial sector. Historical trends suggest similar integrations lead to increased usage but require careful regulatory management.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |