- Senator Cruz critiques Warren and China’s stance on Bitcoin.

- Bitcoin’s decentralized nature cited as the reason.

- Continued advocacy for crypto-friendly policies by Cruz.

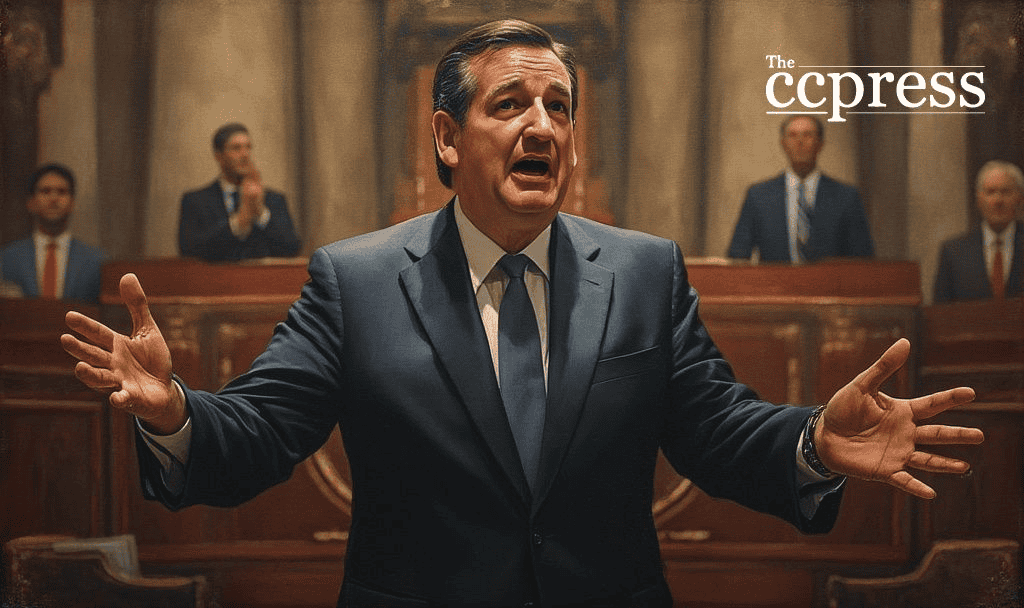

Senator Ted Cruz stated on March 29, 2025, that both Elizabeth Warren and China oppose Bitcoin because it operates outside governmental control.

Cruz’s comments resonate with ongoing debates regarding Bitcoin’s decentralized control versus government oversight. His critique suggests an alignment with broader interests in financial autonomy and innovation.

Cruz’s Advocacy for Decentralized Finance

Senator Ted Cruz has repeatedly positioned himself as an advocate for decentralized finance. He has pushed against regulations he claims could stifle economic innovations, aligning with his vision for Texas to be a crypto hub.

Cruz’s Allegations Against Warren and China

Cruz’s allegations include Elizabeth Warren’s regulatory-focused policies and China’s historical actions against Bitcoin. He argues these reflect a desire for governmental control over financial systems.

“Elizabeth Warren hates Bitcoin for the same reason that communist China hates Bitcoin because they cannot control it because it is decentralized that is the reason I love it I want it out of government control I don’t want Federal bureaucrats having control over it,” said Senator Ted Cruz.

The immediate reaction to Cruz’s statement led to increased discussions in the financial sector, though the direct impact on Bitcoin’s price remains unclear. Bitcoin’s price at the time was $82,390.32, reflecting market sensitivity to regulatory commentaries.

Implications of Cryptocurrency Regulation

Financial implications of Cruz’s advocacy suggest potential resistance to centralized digital currencies, such as Central Bank Digital Currencies (CBDCs). Historically, his actions include sponsoring the Anti-CBDC Surveillance State Act, demonstrating commitment to safeguarding monetary privacy and autonomy. Cryptocurrency data on March 29, 2025, highlighted Bitcoin’s leading status with a market capitalization of $1.63 trillion, accounting for a 61.26% dominance. The price, $82,390.32, saw recent declines following broader market trends (data from CoinMarketCap shows a 2.16% drop in 24 hours).

Future of Bitcoin and Legislative Discourse

Potential outcomes include shifts in government policies towards technological oversight of cryptocurrencies. Cruz’s critique may influence legislative discourse, potentially impacting future regulatory frameworks. This parallels prior trends where regulatory stances influenced digital markets.