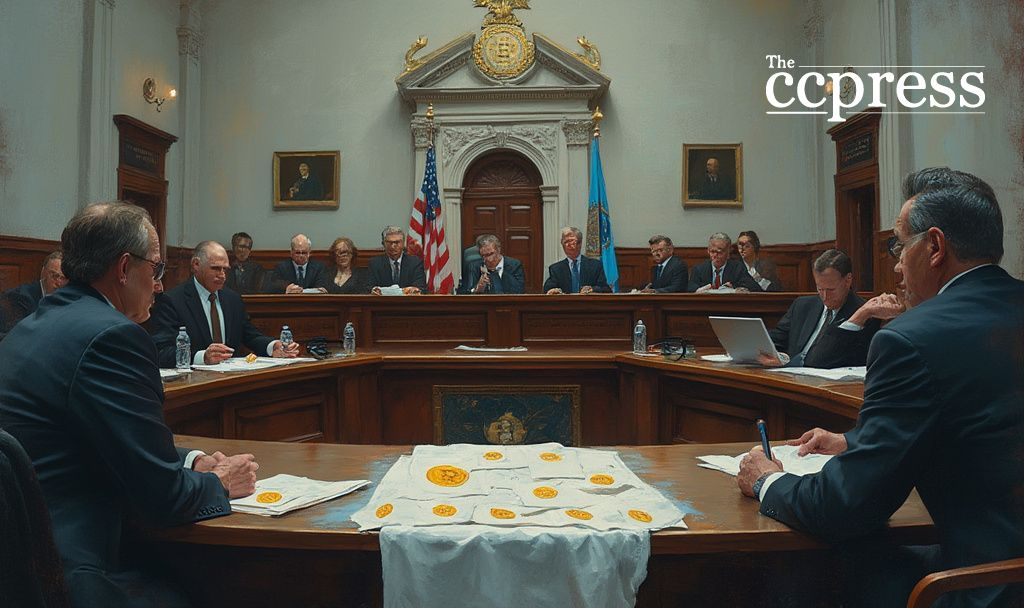

- Bills HB 487 and SB 550 not passed.

- Investment in Bitcoin was proposed for state reserves.

- Florida joined states rejecting Bitcoin reserve ideas.

The failure of Florida’s Bitcoin Reserve Bills carries significant implications, as it ends one of the earliest attempts to incorporate cryptocurrency into state-level financial strategies. Market observers caution this may impact similar efforts nationally.

Florida legislature’s session concluded with the decision to halt Bills HB 487 and SB 550. Representative Barnaby intended to position the state ahead economically by allowing public investment in Bitcoin. As Representative Barnaby put it,

“I filed the bill to position Florida on the cutting-edge of economic policy, believing Bitcoin could serve as a hedge against inflation and help protect state assets during economic downturns.”Both bills faced opposition and did not proceed. These bills sought to involve Florida’s Chief Financial Officer in managing public funds through a Bitcoin reserve. Senator Gruters expanded the plan to cover other digital assets. Despite legislative efforts, the bills were withdrawn on May 3, 2025.

The bills’ failure marks a setback in adopting cryptocurrency at the state level. Florida had aimed to establish a Bitcoin reserve while offering exemptions from specific security rules, showcasing regulatory flexibility. If successful, the initiative could have spurred other states to follow Florida’s lead, altering the national landscape for public cryptocurrency investments. Observers note the decision reflects caution in state-level cryptocurrency adoption, affecting the wider market and regulatory frameworks.

The discussion on state-level cryptocurrency reserves continues to evolve. While Florida’s bills have been halted, the broader trend of adopting digital assets in government finance remains active. Policymakers continue to explore Bitcoin as a treasury alternative, signaling ongoing interest despite legislative setbacks.

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |