If you are even remotely informed about cryptocurrencies, then you surely know that one of the biggest problems of the crypto market stems from the fact that most cryptocurrencies are extremely volatile.

Before we go even further, it’s important to note that there’s no such thing as a perfectly stable currency. In fact, even some of the world’s most valuable currencies such as the USD, EUR, and GBP are subjected to various fluctuations. However, just like any person with basic financial knowledge can tell you, these fluctuations are so small that the currencies in question can still be used safely.

Currently, the world is struggling between sticking to the mainstream currencies and adopting cryptos which, truth be told, are still too volatile, hence, fairly impractical for mainstream use. That’s exactly what the so-called “stablecoins” are trying to change.

Stablecoins – simple definition

To put it simply, a stablecoin is a cryptocurrency with very stable prices measured in fiat currency. They achieve this stable grounding by being pegged or directly linked to real-world assets such as typical currencies, and even other types of assets such as oil or gold.

Just like other cryptocurrencies, stablecoins use the blockchain technology. They boast the same advantages as most cryptos, namely, they are decentralized, and cannot be controlled by any nation-wide or central authority or institution.

Why are stablecoins important?

Designed to be used as a unit of account and even as a store of value (something that most cryptos struggle with), it’s somewhat easy to understand why stablecoins can have substantial effects across the world’s markets. There are some that even believe that stablecoins are the true realization of what blockchain technology and cryptocurrencies are capable of.

This is because stability (the lack of volatility) is incredibly important for any currency, not just cryptocurrencies. Volatility makes currencies unreliable and, in the case of cryptocurrencies, it’s probably the biggest challenge that actually prevents mainstream adoption.

To put everything into perspective, a perfect stablecoin would have to achieve three properties of a currency: to act as a medium of exchange, to be able to store value, to be used as a unit of account.

In short, it would have to be able to allow its users to trade without problems, it would maintain wealth reliably over time, and it would be used as a unit to define and compare market values. Probably the most important trait of stablecoins is their ability to act very much as a fiat currency would, and that alone is enough to bring value to almost all stablecoin projects out there.

Imagine being a merchant and having received a crypto payment in return for your service which is worth $X. If the said crypto depreciates tomorrow by 30%, then you would receive a lot less than what your service is worth. The same goes for customers who use crypto to pay for services. What if the price of crypto would increase by 50% right when you wanted to pay the merchant for a specific service?

That’s why stablecoins are probably the best crypto options, for merchants and “non-hardcore” traders at least.

Some crypto enthusiast might be surprised to hear that there are, in fact, various categories of stablecoins.

Types of stablecoins

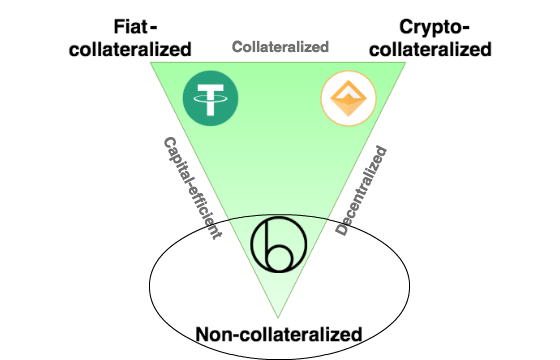

There are three types of stablecoins: fiat-collateralized stablecoins, crypto-collateralized stablecoins, and non-collateralized stablecoins.

Fiat-collateralized stablecoins are the ones that are being backed by typical fiat currencies and reserves such as USD and EUR. This is the most popular and straightforward type of stablecoin. The main disadvantage of this type of stablecoin is the fact that it requires the presence of a third-party or central authority.

Crypto-collateralized stablecoins are backed by cryptocurrencies. As one can imagine, these types of stablecoins are probably the most “risky” type of stablecoins, as the cryptocurrencies that account for the price stability of them are still volatile, as mentioned at the beginning of this article. These types of stablecoins are very vulnerable in the face of a “black swan” event. In short, if the assets that back them become worthless, they become worthless as well.

This brings us to the non-collateralized stablecoins that are backed by “nothing.” One could say that they are backed by the expectation that they can retain a certain value and nothing more. Instead, their supply and price stability is governed by a smart contract algorithm. These smart contracts automatically expand and shrink in order to keep the price of the said stablecoin stable.

Currently, there aren’t that many stablecoin projects. Some of the most popular stablecoins are Tether (USTD), TrueUSD (TUSD), MakerDAO (MKR), and Havven (HVN). Tether boasts a 1-to-1 peg ration against the USD. The conversion rate is 1 Tether USDT to $1. In the case of MakerDAO, each “Dai” is worth $1 USD. TrueUSD is a fully USD-backed stablecoin with a 100% rate of collateralization.

Considering everything that’s said, it’s quite clear that stablecoins have both advantages and disadvantages

Pros and cons of stablecoins

One of the main pros of stablecoins is the fact that they offer stability for trading purposes. They are also notorious for ensuring a bit of peace of mind for the holders and traders alike. Also noteworthy is the fact that stablecoins can be liquidated a lot easier in case of market failure than typical cryptocurrencies. Finally, while they are not perfect regarding stability, they do offer protection from extreme volatility.

Unfortunately, stablecoins do come with a series of cons as well. Due to their nature, stablecoins tend to be more centralized when compared to their typical crypto counterparts. All types of stablecoins seem to be very affected by a phenomenon called the “blockchain oracle problem.” Lastly, stablecoins are more prone to manipulation (both supply manipulation and crypto market manipulation).

Conclusion

The future for stablecoins is not a very “stable” one, as there’s really no telling if stablecoins will see mainstream adoption. However, the concepts behind stablecoins are without a doubt very interesting, and the advantages they bring are of a tangible manner.

Be that as it may, the biggest present issue with stablecoins is not their level of adoption but rather the fact that there is still no stablecoin that doesn’t compromise security and decentralization to achieve its goal.