Using credit or debit cards is one of the easiest ways of acquiring Bitcoin. This purchasing option is available on most exchanges, and it conveniently and instantly delivers your Bitcoins.

Most of these sites have a cash limit on the credit card, before making any purchases you have to check with your bank and find out what cash limit you have on your card.

Cryptocurrency exchanges usually charge a fee of 4% for card purchases. Because of this, it would be best to consider using a bank transfer to buy Bitcoin, as you will save on purchasing fees. But if time is a problem, cards are the way to go.

Below is a list of exchanges that allow you to buy Bitcoins with a credit card.

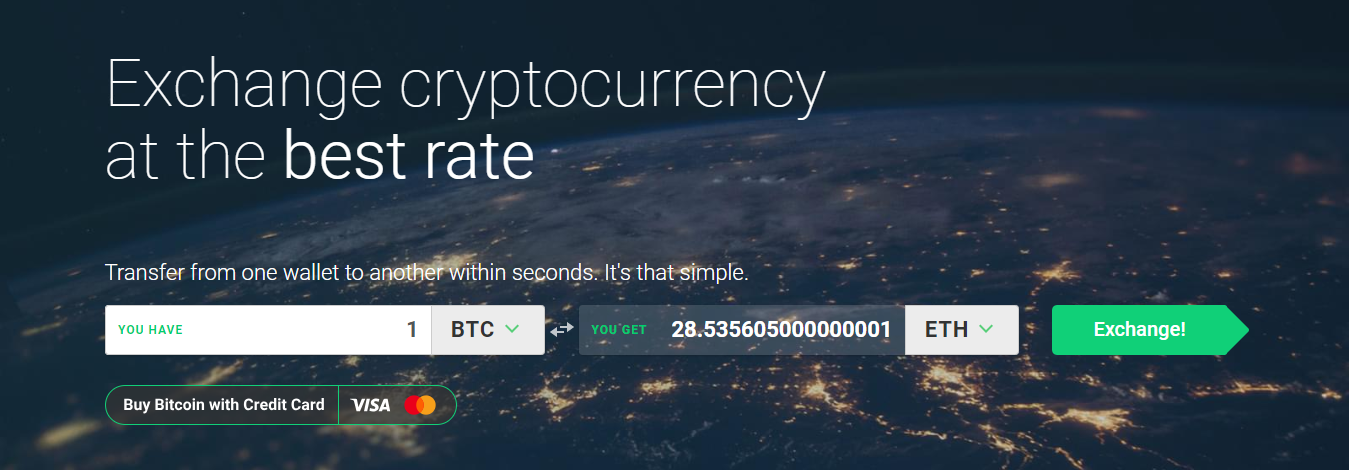

1. Changelly

Changelly is a top rated crypto exchange that was established in 2013 in the Czech Republic. It allows users to trade with a list of cryptocurrencies but does not support fiat trading. It is also a crypto exchange recognized for its convenient rates.

More than 700,000 users from all over the world have registered on this platform. Currently, this exchange supports payments in over 35 currencies. This is because the exchange employs the automatic trading robot which directly links leading platforms like Bittrex and Poloniex. This robot finds out the best possible exchange rates in a matter of seconds. The platform has listed more than 80 altcoins and tokens.

This exchange charges a 0.5% fee on all its transactions and offers the possibility of buying unlimited amounts of cryptocurrencies. After a few transactions are limited in the first month, the exchange makes available the unlimited buying amount of cryptocurrencies.

2. Coinbase

Coinbase is one of the most popular and reputable exchanges in the industry. It was founded in 2012 in San Francisco. Today, the company is offering its services in more than 32 countries from all over the world. It has an extensive database comprising of millions of users.

Coinbase is one of the most popular and reputable exchanges in the industry. It was founded in 2012 in San Francisco. Today, the company is offering its services in more than 32 countries from all over the world. It has an extensive database comprising of millions of users.

Coinbase’s credit and debit card purchasing fees represent a flat fee of 3.99%. This is a low figure compared to other crypto exchanges from America and Europe.

Coinbase’s buying limits are quite low when compared to its competition. Based on the verification level of your account, you are allowed to purchase different amounts of cryptocurrency daily. The highest tier of verification lets users purchase up to $50,000 daily on Coinbase.

Coinbase charges no fees for depositing currency onto the exchange, the transaction fee ensues when the purchase is made.

It should be noted that US citizens cannot make card purchases, but they can make debit card purchases.

3. Coinmama

Coinmama‘s website features different packages in which you can purchase a set amount of cryptocurrency. If the amount you plan on buying is not in the plans then you can specify the amount of Bitcoin you wish to buy.

Unlike other exchanges, it should be noted that Coinmama does not provide you with a wallet for depositing your purchased cryptocurrency. Instead, they require your wallet address to send the bought currency to. This shouldn’t pose a problem if you have your own wallet.

Coinmama is a reputable exchange as it has a responsive and reliable support team and has been activating in the crypto space for a while now. The company is headquartered in Israel and operates in several countries and a majority of states from the US.

Coinmama takes a fee of 5% for credit and debit purchases. Even though this fee is higher than Coinbase, they offer instant transfers and higher purchasing limits.

The exchange features high purchasing limits of a maximum of $5,000 daily and $20,000 monthly. The minimum purchase limit if of $60 USD.

4. CEX.io

CEX.io is a crypto exchange established since 2013 and have their headquarters in London, UK. The platform features solid security measures, high liquidity, and cross-platform trading through their site, mobile app, and API solutions. Over 2 million active traders use their website. CEX.io also lets users margin trade and have nearly 100% uptime.

Their services are available to 24 US states, and 99% of countries from all over the world. The states that are not supported by the exchange are: Alaska, Alabama, Arkansas, Arizona, Colorado, Florida, Guam, Georgia, Idaho, Iowa, Kansas, Louisiana, Michigan, Maryland, Mississippi, Nebraska, New Hampshire, New Jersey, North Dakota, North Carolina, Ohio, Oregon, Texas, Tennessee, U.S. Virgin Islands, Vermont, Virginia, Washington.

CEX.io offers competitive fees, with 3.9% on credit and debit card being charged for deposits. When you sell Bitcoin back to your credit or debit card, a 2.9% fee will occur. This is a unique feature to CEX.io as a majority of exchanges do not the selling back to a credit card.

CEX.io charges a premium when the purchase is made. This essentially means that Bitcoin or other cryptocurrencies are sold at a price higher than the standard rate.

5. Luno

Luno is a popular exchange that lets users trade with Bitcoin paired against fiat currencies and Ethereum. Depending on your location, this exchange can be an excellent option. Luno is currently available to users from Europe, South Africa, Malaysia, Indonesia, and Nigeria.

Luno also has an application for mobile devices that operates with iOS and Android, allowing users to make purchase and trading of Bitcoin on the go.

Luno’s fees are on the cheaper side of the spectrum. The exchange does not charge a fee for credit and debit card deposits, unlike its rivals. Along with having zero deposit fees, Luno charges a 0.25% taker fee, and 0% maker fee when an order is placed. Due to its fee structure, Luno is one of the cheapest exchanges where you can acquire Bitcoin.

Final Words

Considering the current market rate of Bitcoin, credit and debit card purchases are situated around 5%. Even though this is a rather steep fee for a usual transaction, it is reasonable seeing as an exchange faces security and volatility risks.